Authors

Summary

The ordinary spectrum is restricted in its applications, since it is based on the second order moments (auto and cross-covariances). Alternative approaches to spectrum analysis have been investigated based on other measures of dependence. One such approach was developed for univariate time series by the authors of this paper using the local Gaussian auto-spectrum based on the local Gaussian auto-correlations. This makes it possible to detect local structures in univariate time series that looks like white noise when investigated by the ordinary auto-spectrum. In this paper the local Gaussian approach is extended to a local Gaussian cross-spectrum for multivariate time series. The local Gaussian cross-spectrum has the desirable property that it coincides with the ordinary cross-spectrum for Gaussian time series, which implies that it can be used to detect non-Gaussian traits in the time series under investigation. In particular: If the ordinary spectrum is flat, then peaks and troughs of the local Gaussian spectrum can indicate nonlinear traits, which potentially might reveal local periodic phenomena that goes undetected in an ordinary spectral analysis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

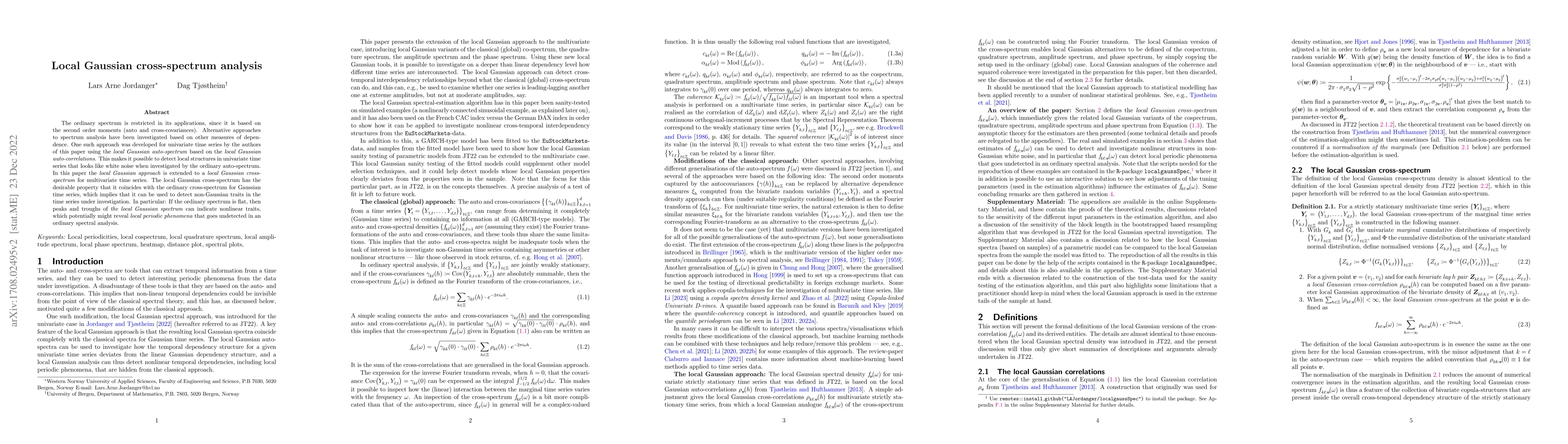

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)