Summary

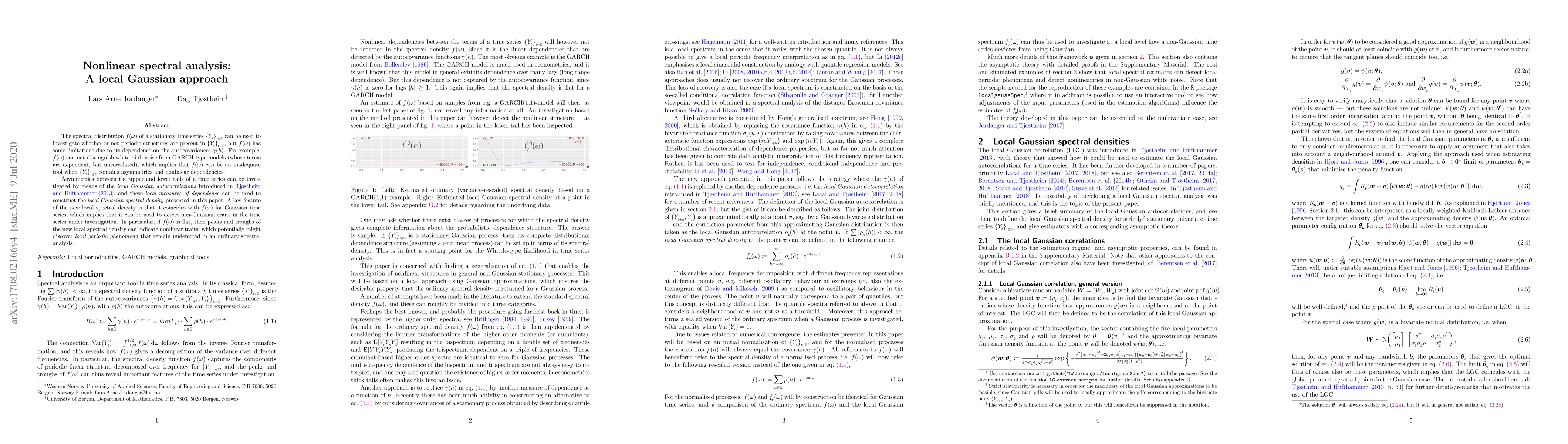

The spectral distribution $f(\omega)$ of a stationary time series $\{Y_t\}_{t\in\mathbb{Z}}$ can be used to investigate whether or not periodic structures are present in $\{Y_t\}_{t\in\mathbb{Z}}$, but $f(\omega)$ has some limitations due to its dependence on the autocovariances $\gamma(h)$. For example, $f(\omega)$ can not distinguish white i.i.d. noise from GARCH-type models (whose terms are dependent, but uncorrelated), which implies that $f(\omega)$ can be an inadequate tool when $\{Y_t\}_{t\in\mathbb{Z}}$ contains asymmetries and nonlinear dependencies. Asymmetries between the upper and lower tails of a time series can be investigated by means of the local Gaussian autocorrelations introduced in Tj{\o}stheim and Hufthammer (2013), and these local measures of dependence can be used to construct the local Gaussian spectral density presented in this paper. A key feature of the new local spectral density is that it coincides with $f(\omega)$ for Gaussian time series, which implies that it can be used to detect non-Gaussian traits in the time series under investigation. In particular, if $f(\omega)$ is flat, then peaks and troughs of the new local spectral density can indicate nonlinear traits, which potentially might discover local periodic phenomena that remain undetected in an ordinary spectral analysis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)