Authors

Summary

In Chakraborti's yard-sale model of an economy, identical agents engage in pairwise trades, resulting in wealth exchanges that conserve each agent's expected wealth. Doob's martingale convergence theorem immediately implies almost sure wealth condensation, i.e., convergence to a state in which a single agent owns the entire economy. If some pairs of agents are not allowed to trade with each other, the martingale convergence theorem still implies local wealth condensation, i.e., convergence to a state in which some agents are wealthy, while all their trading partners are impoverished. In this note, we propose a new, more elementary proof of this result. Unlike the proof based on the martingale convergence theorem, our argument applies to models with a wealth-acquired advantage, and even to certain models with a poverty-acquired advantage.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

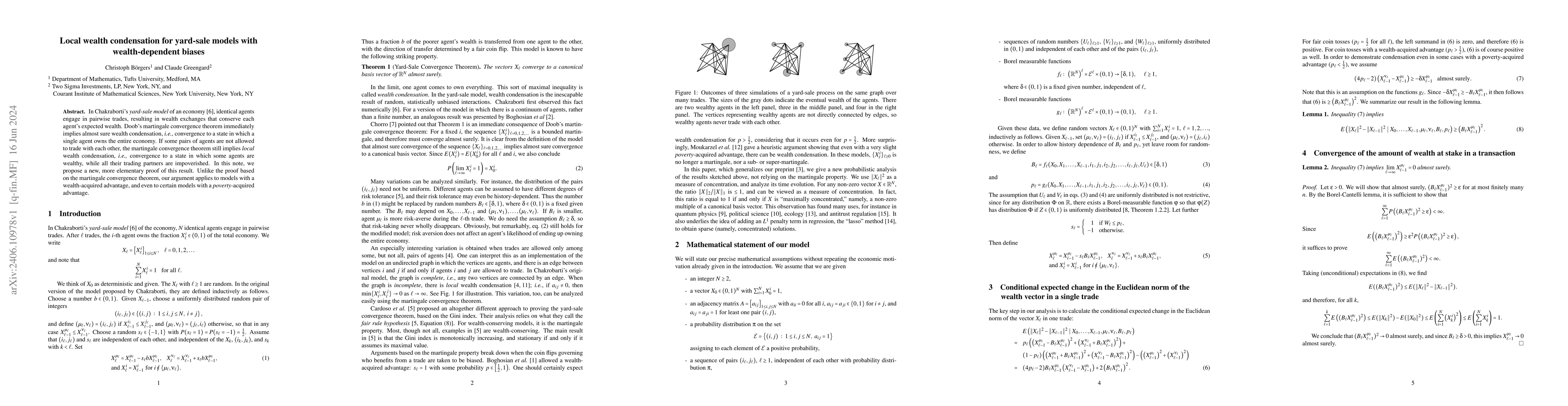

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)