Summary

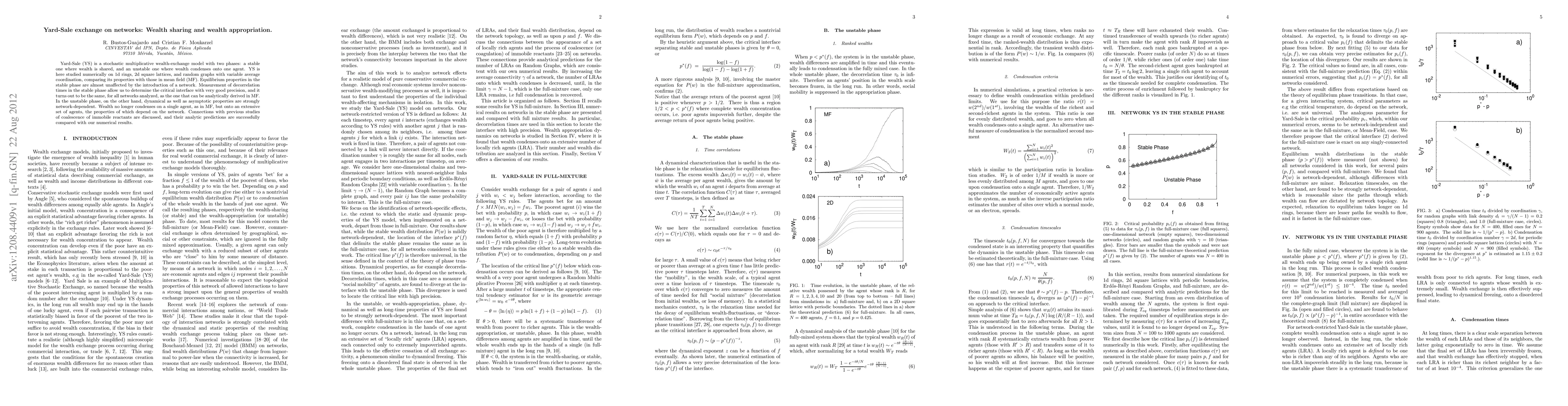

Yard-Sale (YS) is a stochastic multiplicative wealth-exchange model with two phases: a stable one where wealth is shared, and an unstable one where wealth condenses onto one agent. YS is here studied numerically on 1d rings, 2d square lattices, and random graphs with variable average coordination, comparing its properties with those in mean field (MF). Equilibrium properties in the stable phase are almost unaffected by the introduction of a network. Measurement of decorrelation times in the stable phase allow us to determine the critical interface with very good precision, and it turns out to be the same, for all networks analyzed, as the one that can be analytically derived in MF. In the unstable phase, on the other hand, dynamical as well as asymptotic properties are strongly network-dependent. Wealth no longer condenses on a single agent, as in MF, but onto an extensive set of agents, the properties of which depend on the network. Connections with previous studies of coalescence of immobile reactants are discussed, and their analytic predictions are successfully compared with our numerical results.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLocal wealth condensation for yard-sale models with wealth-dependent biases

Christoph Börgers, Claude Greengard

Study of the Extended Yard Sale model of wealth distribution on Erdős-Rényi random networks

Nicolás Vazquez Von Bibow, Juan I. Perotti

| Title | Authors | Year | Actions |

|---|

Comments (0)