Summary

Given a set of assets and an investment capital, the classical portfolio selection problem consists in determining the amount of capital to be invested in each asset in order to build the most profitable portfolio. The portfolio optimization problem is naturally modeled as a mean-risk bi-criteria optimization problem where the mean rate of return of the portfolio must be maximized whereas a given risk measure must be minimized. Several mathematical programming models and techniques have been presented in the literature in order to efficiently solve the portfolio problem. A relatively recent promising line of research is to exploit clustering information of an assets network in order to develop new portfolio optimization paradigms. In this paper we endow the assets network with a metric based on correlation coefficients between assets' returns, and show how classical location problems on networks can be used for clustering assets. In particular, by adding a new criterion to the portfolio selection problem based on an objective function of a classical location problem, we are able to measure the effect of clustering on the selected assets with respect to the non-selected ones. Most papers dealing with clustering and portfolio selection models solve these problems in two distinct steps: cluster first and then selection. The innovative contribution of this paper is that we propose a Mixed-Integer Linear Programming formulation for dealing with this problem in a unified phase. The effectiveness of our approach is validated reporting some preliminary computational experiments on some real financial dataset.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

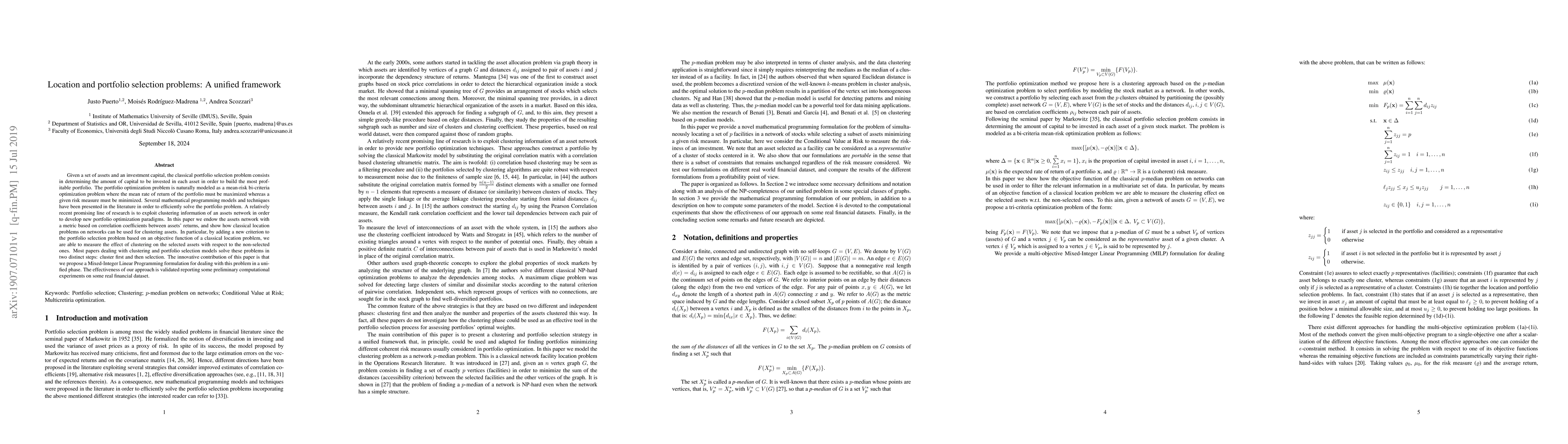

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRobust Portfolio Selection Problems: A Comprehensive Review

Alireza Ghasemi, Alireza Ghahtarani, Ahmed Saif

A Unified Framework for Fast Large-Scale Portfolio Optimization

Abolfazl Safikhani, Pawel Polak, Weichuan Deng et al.

No citations found for this paper.

Comments (0)