Summary

In this paper, we provide a comprehensive review of recent advances in robust portfolio selection problems and their extensions, from both operational research and financial perspectives. A multi-dimensional classification of the models and methods proposed in the literature is presented, based on the types of financial problems, uncertainty sets, robust optimization approaches, and mathematical formulations. Several open questions and potential future research directions are identified.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

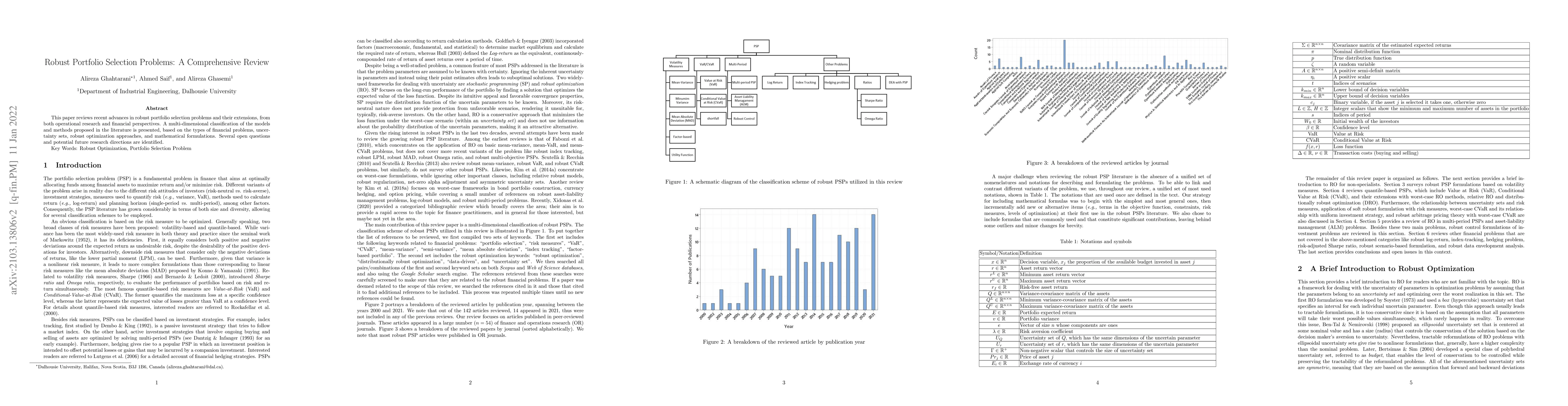

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAdaptive Robust Online Portfolio Selection

Hoi Ying Wong, Tony Sit, Man Yiu Tsang

Robust equilibrium strategy for mean-variance-skewness portfolio selection problem

Zhihao Hu, Nan-jing Huang, Jian-hao Kang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)