Summary

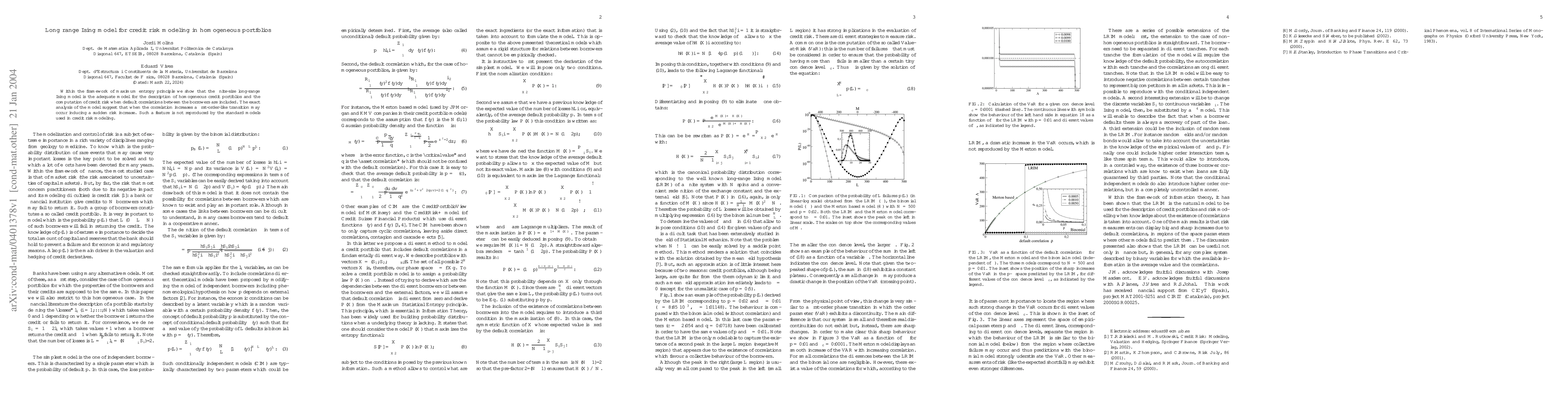

Within the framework of maximum entropy principle we show that the finite-size long-range Ising model is the adequate model for the description of homogeneous credit portfolios and the computation of credit risk when default correlations between the borrowers are included. The exact analysis of the model suggest that when the correlation increases a first-order-like transition may occur inducing a sudden risk increase. Such a feature is not reproduced by the standard models used in credit risk modeling.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Comments (0)