Authors

Summary

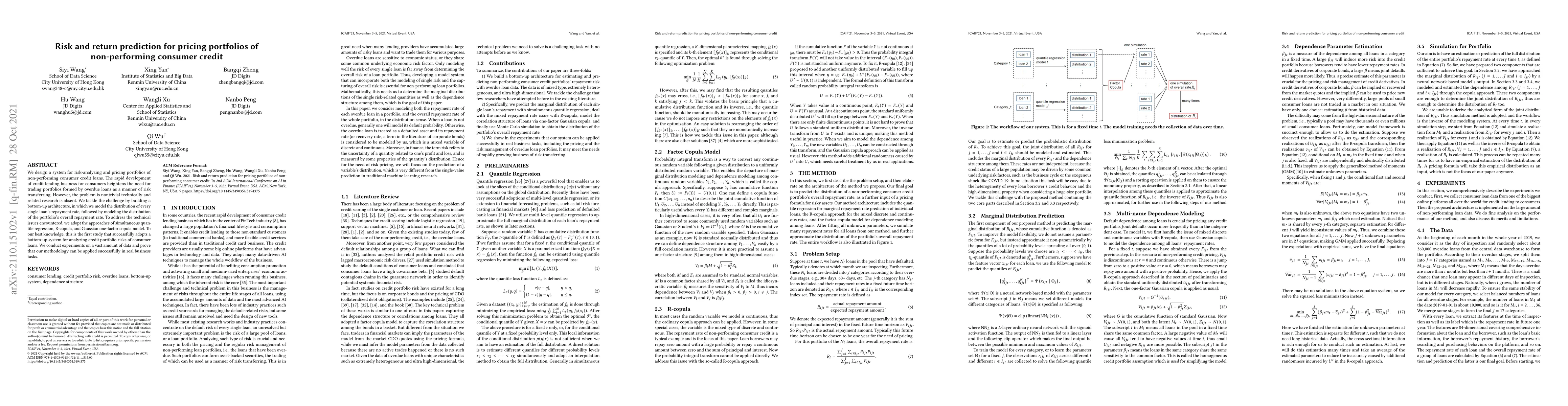

We design a system for risk-analyzing and pricing portfolios of non-performing consumer credit loans. The rapid development of credit lending business for consumers heightens the need for trading portfolios formed by overdue loans as a manner of risk transferring. However, the problem is nontrivial technically and related research is absent. We tackle the challenge by building a bottom-up architecture, in which we model the distribution of every single loan's repayment rate, followed by modeling the distribution of the portfolio's overall repayment rate. To address the technical issues encountered, we adopt the approaches of simultaneous quantile regression, R-copula, and Gaussian one-factor copula model. To our best knowledge, this is the first study that successfully adopts a bottom-up system for analyzing credit portfolio risks of consumer loans. We conduct experiments on a vast amount of data and prove that our methodology can be applied successfully in real business tasks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOffline Deep Reinforcement Learning for Dynamic Pricing of Consumer Credit

Raad Khraishi, Ramin Okhrati

Credit risk for large portfolios of green and brown loans: extending the ASRF model

Sergio Scarlatti, Alessandro Ramponi

| Title | Authors | Year | Actions |

|---|

Comments (0)