Summary

This paper studies the long-term growth rate of expected utility from holding a leveraged exchanged-traded fund (LETF), which is a constant proportion portfolio of the reference asset. Working with the power utility function, we develop an analytical approach that employs martingale extraction and involves finding the eigenpair associated with the infinitesimal generator of a Markovian time-homogeneous diffusion. We derive explicitly the long-term growth rates under a number of models for the reference asset, including the geometric Brownian motion model, GARCH model, inverse GARCH model, extended CIR model, 3/2 model, quadratic model, as well as the Heston and 3/2 stochastic volatility models. We also investigate the impact of stochastic interest rate such as the Vasicek model and the inverse GARCH short rate model. We determine the optimal leverage ratio for the long-term investor and examine the effects of model parameters.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

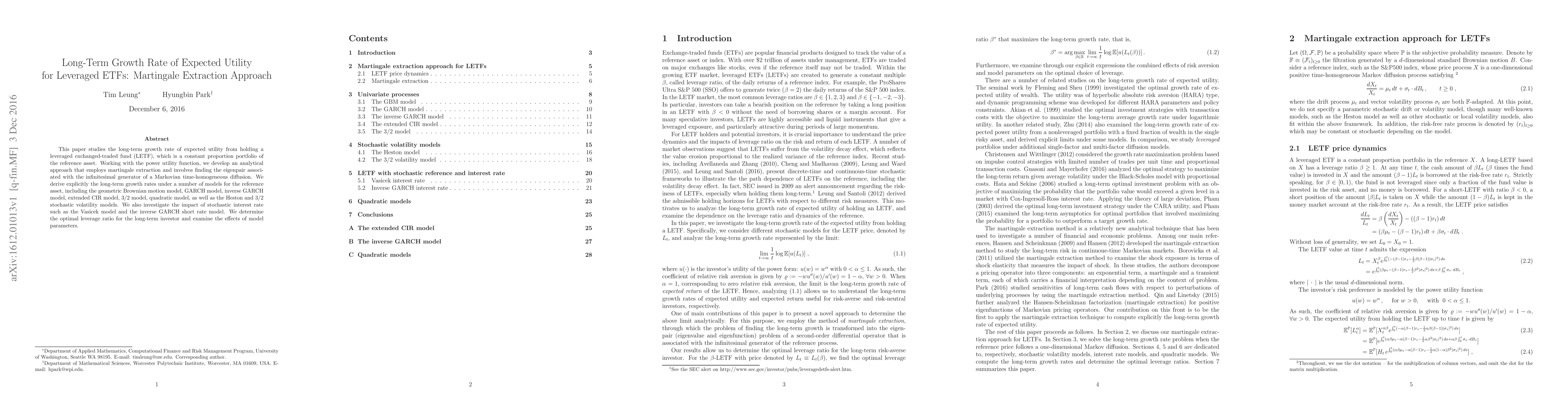

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRobust Long-Term Growth Rate of Expected Utility for Leveraged ETFs

Hyungbin Park, Tim Leung, Heejun Yeo

| Title | Authors | Year | Actions |

|---|

Comments (0)