Summary

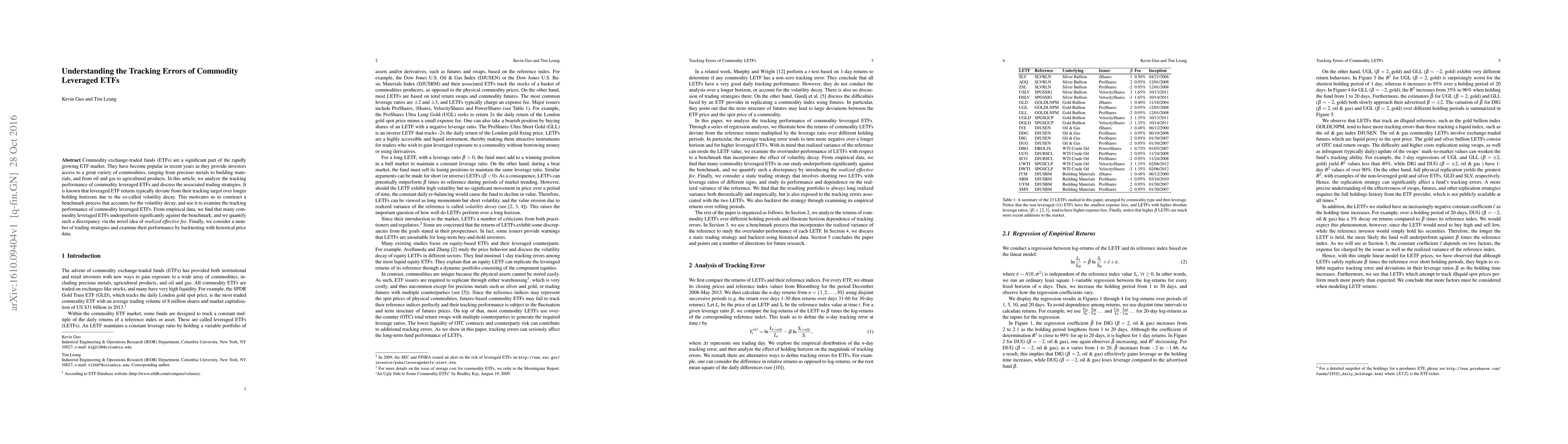

Commodity exchange-traded funds (ETFs) are a significant part of the rapidly growing ETF market. They have become popular in recent years as they provide investors access to a great variety of commodities, ranging from precious metals to building materials, and from oil and gas to agricultural products. In this article, we analyze the tracking performance of commodity leveraged ETFs and discuss the associated trading strategies. It is known that leveraged ETF returns typically deviate from their tracking target over longer holding horizons due to the so-called volatility decay. This motivates us to construct a benchmark process that accounts for the volatility decay, and use it to examine the tracking performance of commodity leveraged ETFs. From empirical data, we find that many commodity leveraged ETFs underperform significantly against the benchmark, and we quantify such a discrepancy via the novel idea of \emph{realized effective fee}. Finally, we consider a number of trading strategies and examine their performance by backtesting with historical price data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCompounding Effects in Leveraged ETFs: Beyond the Volatility Drag Paradigm

Chung-Han Hsieh, Jow-Ran Chang, Hui Hsiang Chen

Robust Long-Term Growth Rate of Expected Utility for Leveraged ETFs

Hyungbin Park, Tim Leung, Heejun Yeo

| Title | Authors | Year | Actions |

|---|

Comments (0)