Summary

A common belief is that leveraged ETFs (LETFs) suffer long-term performance decay due to \emph{volatility drag}. We show that this view is incomplete: LETF performance depends fundamentally on return autocorrelation and return dynamics. In markets with independent returns, LETFs exhibit positive expected compounding effects on their target multiples. In serially correlated markets, trends enhance returns, while mean reversion induces underperformance. With a unified framework incorporating AR(1) and AR-GARCH models, continuous-time regime switching, and flexible rebalancing frequencies, we demonstrate that return dynamics -- including return autocorrelation, volatility clustering, and regime persistence -- determine whether LETFs outperform or underperform their targets. Empirically, using about 20 years of SPDR S\&P~500 ETF and Nasdaq-100 ETF data, we confirm these theoretical predictions. Daily-rebalanced LETFs enhance returns in momentum-driven markets, whereas infrequent rebalancing mitigates losses in mean-reverting regimes.

AI Key Findings

Generated Jun 08, 2025

Methodology

The research employs a unified framework incorporating AR(1) and AR-GARCH models, continuous-time regime switching, and flexible rebalancing frequencies to analyze return dynamics in leveraged ETFs.

Key Results

- Leveraged ETFs (LETFs) can exhibit positive expected compounding effects on their target multiples in markets with independent returns.

- Trends in serially correlated markets enhance LETF returns, while mean reversion induces underperformance.

- Daily-rebalanced LETFs enhance returns in momentum-driven markets, and infrequent rebalancing mitigates losses in mean-reverting regimes.

Significance

This study is important as it challenges the prevalent belief that LETFs inevitably suffer long-term performance decay due to volatility drag, providing a more nuanced understanding of LETF performance based on return autocorrelation and dynamics.

Technical Contribution

The paper presents a comprehensive framework that integrates various return dynamics (autocorrelation, volatility clustering, regime persistence) to explain LETF performance, moving beyond the traditional volatility drag narrative.

Novelty

This research distinguishes itself by demonstrating that the performance of LETFs is contingent on return dynamics, rather than solely on volatility, thereby offering a more sophisticated perspective on LETF behavior.

Limitations

- The study focuses on specific models (AR(1), AR-GARCH, regime-switching) which may not capture all possible return dynamics in the market.

- Empirical analysis is limited to SPDR S&P 500 ETF and Nasdaq-100 ETF data over approximately 20 years.

Future Work

- Extending the analysis to other asset classes and ETFs beyond equity indices.

- Investigating the impact of higher-order return autocorrelations and more complex return dynamics on LETF performance.

Paper Details

PDF Preview

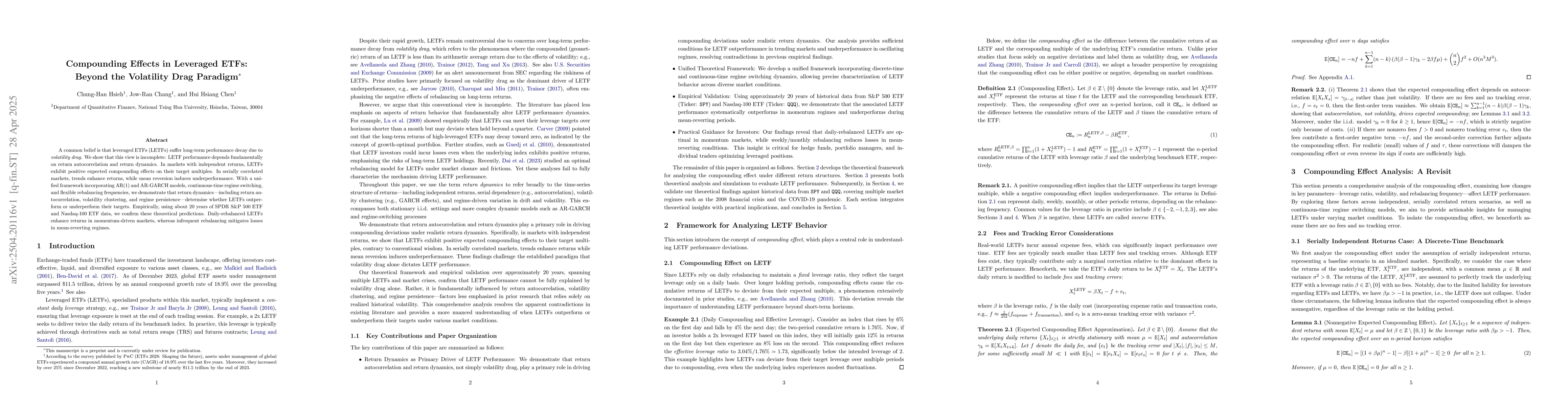

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)