Summary

In this article, we consider the small-time asymptotics of options on a \emph{Leveraged Exchange-Traded Fund} (LETF) when the underlying Exchange Traded Fund (ETF) exhibits both local volatility and jumps of either finite or infinite activity. Our main results are closed-form expressions for the leading order terms of off-the-money European call and put LETF option prices, near expiration, with explicit error bounds. We show that the price of an out-of-the-money European call on a LETF with positive (negative) leverage is asymptotically equivalent, in short-time, to the price of an out-of-the-money European call (put) on the underlying ETF, but with modified spot and strike prices. Similar relationships hold for other off-the-money European options. In particular, our results suggest a method to hedge off-the-money LETF options near expiration using options on the underlying ETF. Finally, a second order expansion for the corresponding implied volatility is also derived and illustrated numerically.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

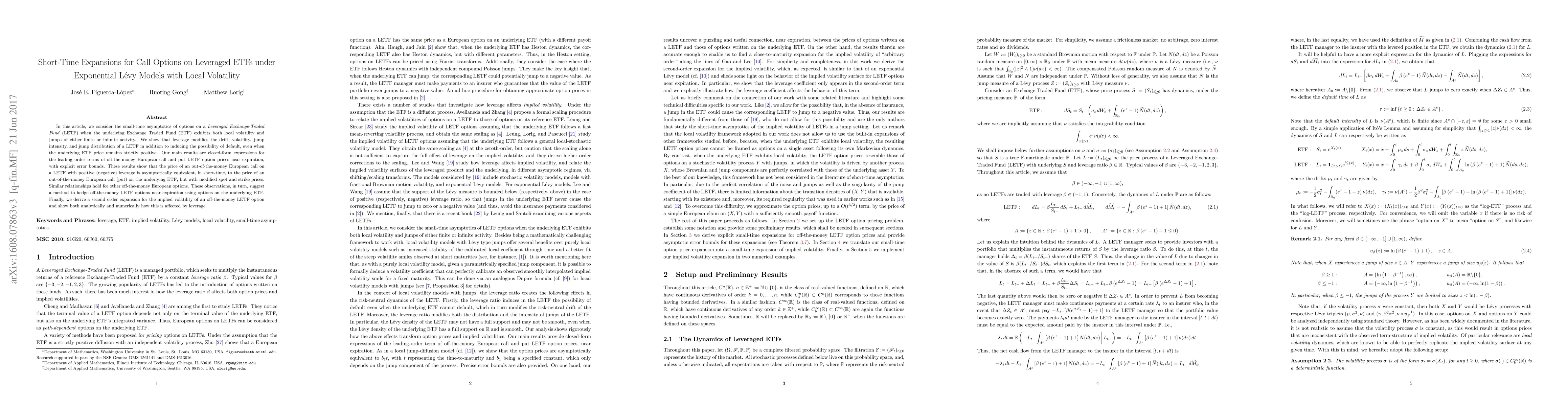

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAsymptotics for Short Maturity Asian Options in Jump-Diffusion models with Local Volatility

Dan Pirjol, Lingjiong Zhu

| Title | Authors | Year | Actions |

|---|

Comments (0)