Summary

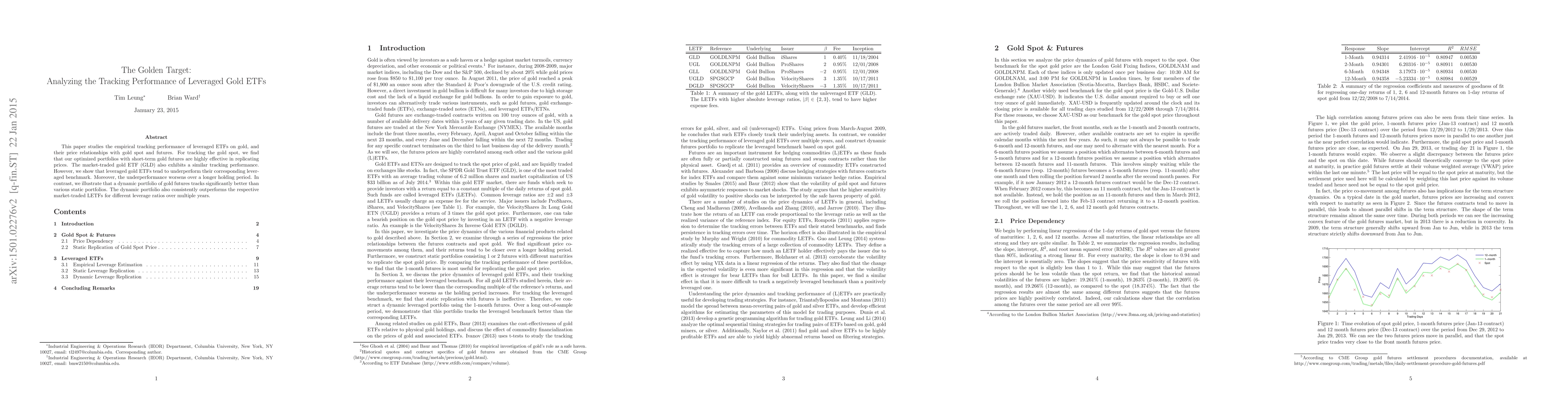

This paper studies the empirical tracking performance of leveraged ETFs on gold, and their price relationships with gold spot and futures. For tracking the gold spot, we find that our optimized portfolios with short-term gold futures are highly effective in replicating prices. The market-traded gold ETF (GLD) also exhibits a similar tracking performance. However, we show that leveraged gold ETFs tend to underperform their corresponding leveraged benchmark. Moreover, the underperformance worsens over a longer holding period. In contrast, we illustrate that a dynamic portfolio of gold futures tracks significantly better than various static portfolios. The dynamic portfolio also consistently outperforms the respective market-traded LETFs for different leverage ratios over multiple years.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCompounding Effects in Leveraged ETFs: Beyond the Volatility Drag Paradigm

Chung-Han Hsieh, Jow-Ran Chang, Hui Hsiang Chen

Robust Long-Term Growth Rate of Expected Utility for Leveraged ETFs

Hyungbin Park, Tim Leung, Heejun Yeo

| Title | Authors | Year | Actions |

|---|

Comments (0)