Authors

Summary

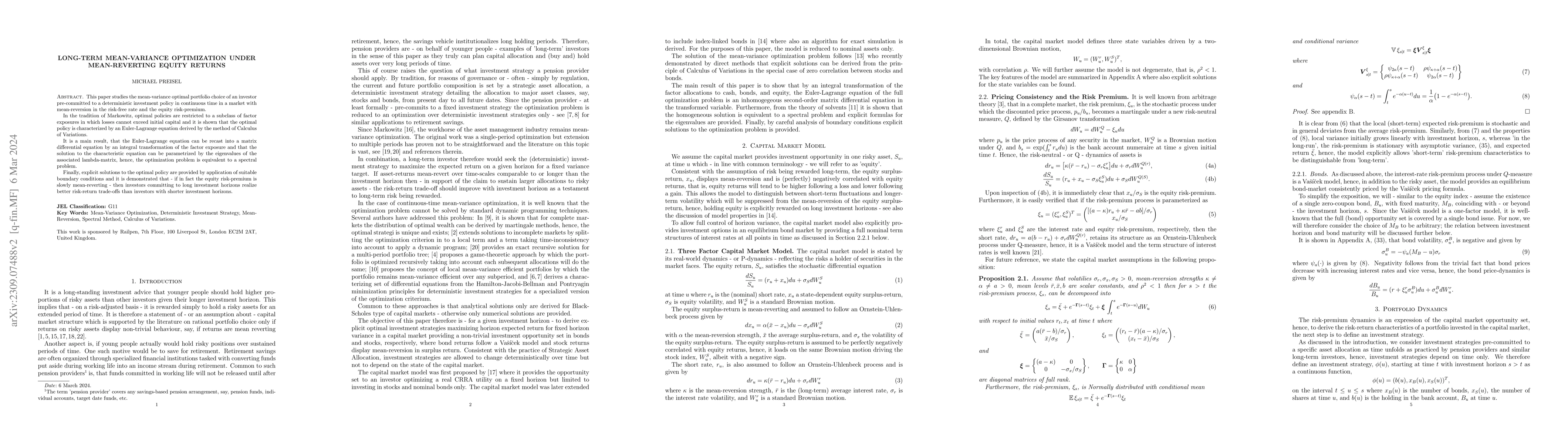

This paper studies the mean-variance optimal portfolio choice of an investor pre-committed to a deterministic investment policy in continuous time in a market with mean-reversion in the risk-free rate and the equity risk-premium. In the tradition of Markowitz, optimal policies are restricted to a subclass of factor exposures in which losses cannot exceed initial capital and it is shown that the optimal policy is characterized by an Euler-Lagrange equation derived by the method of Calculus of Variations. It is a main result, that the Euler-Lagrange equation can be recast into a matrix differential equation by an integral transformation of the factor exposure and that the solution to the characteristic equation can be parametrized by the eigenvalues of the associated lambda-matrix, hence, the optimization problem is equivalent to a spectral problem. Finally, explicit solutions to the optimal policy are provided by application of suitable boundary conditions and it is demonstrated that - if in fact the equity risk-premium is slowly mean-reverting - then investors committing to long investment horizons realize better risk-return trade-offs than investors with shorter investment horizons.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStrategic mean-variance investing under mean-reverting stock returns

Søren Fiig Jarner

Portfolio Optimization Rules beyond the Mean-Variance Approach

Maxime Markov, Vladimir Markov

No citations found for this paper.

Comments (0)