Summary

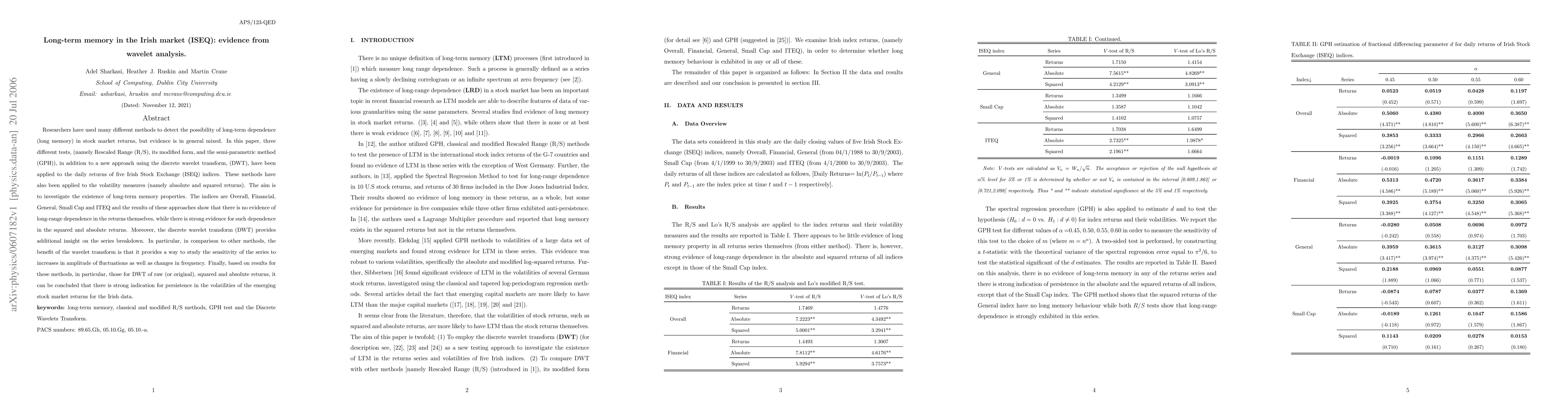

Researchers have used many different methods to detect the possibility of long-term dependence (long memory) in stock market returns, but evidence is in general mixed. In this paper, three different tests, (namely Rescaled Range (R/S), its modified form, and the semi-parametric method (GPH)), in addition to a new approach using the discrete wavelet transform, (DWT), have been applied to the daily returns of five Irish Stock Exchange (ISEQ) indices. These methods have also been applied to the volatility measures (namely absolute and squared returns). The aim is to investigate the existence of long-term memory properties. The indices are Overall, Financial, General, Small Cap and ITEQ and the results of these approaches show that there is no evidence of long-range dependence in the returns themselves, while there is strong evidence for such dependence in the squared and absolute returns. Moreover, the discrete wavelet transform (DWT) provides additional insight on the series breakdown. In particular, in comparison to other methods, the benefit of the wavelet transform is that it provides a way to study the sensitivity of the series to increases in amplitude of fluctuations as well as changes in frequency. Finally, based on results for these methods, in particular, those for DWT of raw (or original), squared and absolute returns, it can be concluded that there is strong indication for persistence in the volatilities of the emerging stock market returns for the Irish data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersComparative Study of Long Short-Term Memory (LSTM) and Quantum Long Short-Term Memory (QLSTM): Prediction of Stock Market Movement

Tariq Mahmood, Ibtasam Ahmad, Malik Muhammad Zeeshan Ansar et al.

Electricity Price Forecasting in the Irish Balancing Market

Ciaran O'Connor, Joseph Collins, Steven Prestwich et al.

Comments (0)