Summary

We prove a large deviations principle for the class of multidimensional affine stochastic volatility models considered in (Gourieroux, C. and Sufana, R., J. Bus. Econ. Stat., 28(3), 2010), where the volatility matrix is modelled by a Wishart process. This class extends the very popular Heston model to the multivariate setting, thus allowing to model the joint behaviour of a basket of stocks or several interest rates. We then use the large deviation principle to obtain an asymptotic approximation for the implied volatility of basket options and to develop an asymptotically optimal importance sampling algorithm, to reduce the number of simulations when using Monte-Carlo methods to price derivatives.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

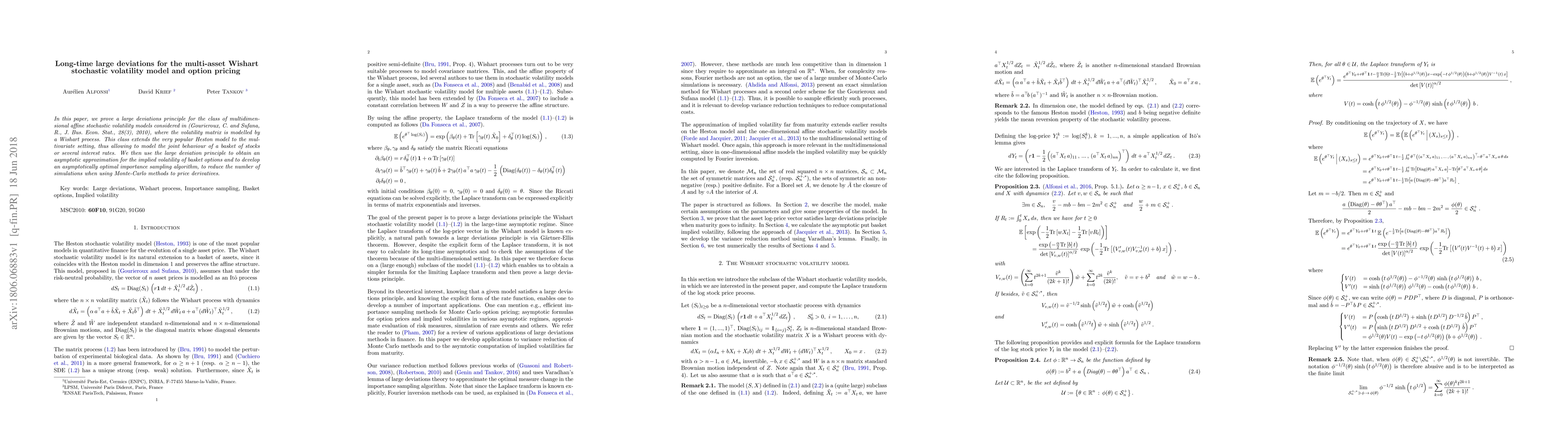

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)