Summary

This work extends the variance reduction method for the pricing of possibly path-dependent derivatives, which was developed in (Genin and Tankov, 2016) for exponential L\'evy models, to affine stochastic volatility models (Keller-Ressel, 2011). We begin by proving a pathwise large deviations principle for affine stochastic volatility models. We then apply a time-dependent Esscher transform to the affine process and use Varadhan's lemma, in the fashion of (Guasoni and Robertson, 2008) and (Robertson, 2010), to approximate the problem of finding the Esscher measure that minimises the variance of the Monte-Carlo estimator. We test the method on the Heston model with and without jumps to demonstrate the numerical efficiency of the method.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

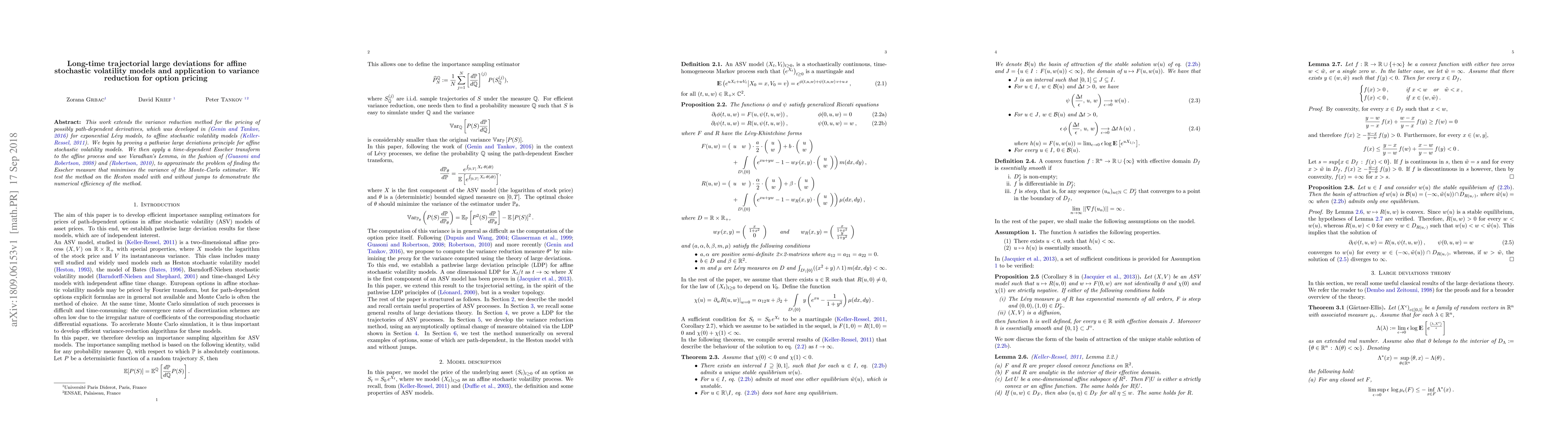

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)