Summary

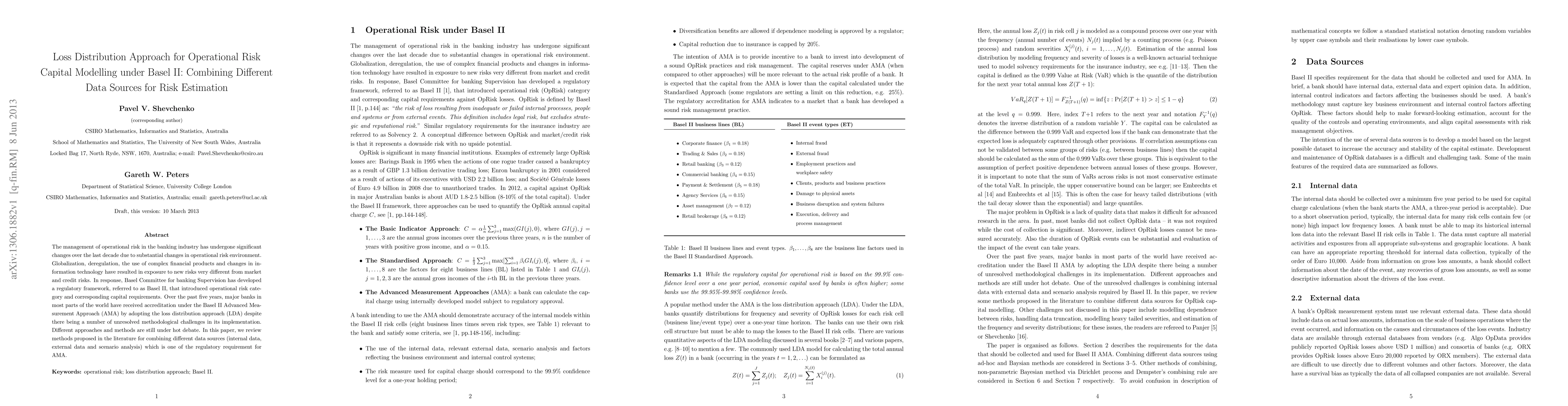

The management of operational risk in the banking industry has undergone significant changes over the last decade due to substantial changes in operational risk environment. Globalization, deregulation, the use of complex financial products and changes in information technology have resulted in exposure to new risks very different from market and credit risks. In response, Basel Committee for banking Supervision has developed a regulatory framework, referred to as Basel II, that introduced operational risk category and corresponding capital requirements. Over the past five years, major banks in most parts of the world have received accreditation under the Basel II Advanced Measurement Approach (AMA) by adopting the loss distribution approach (LDA) despite there being a number of unresolved methodological challenges in its implementation. Different approaches and methods are still under hot debate. In this paper, we review methods proposed in the literature for combining different data sources (internal data, external data and scenario analysis) which is one of the regulatory requirement for AMA.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSemi-nonparametric Estimation of Operational Risk Capital with Extreme Loss Events

Heng Z. Chen, Stephen R. Cosslett

| Title | Authors | Year | Actions |

|---|

Comments (0)