Summary

Many banks adopt the Loss Distribution Approach to quantify the operational risk capital charge under Basel II requirements. It is common practice to estimate the capital charge using the 0.999 quantile of the annual loss distribution, calculated using point estimators of the frequency and severity distribution parameters. The uncertainty of the parameter estimates is typically ignored. One of the unpleasant consequences for the banks accounting for parameter uncertainty is an increase in the capital requirement. This paper demonstrates how the parameter uncertainty can be taken into account using a Bayesian framework that also allows for incorporation of expert opinions and external data into the estimation procedure.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

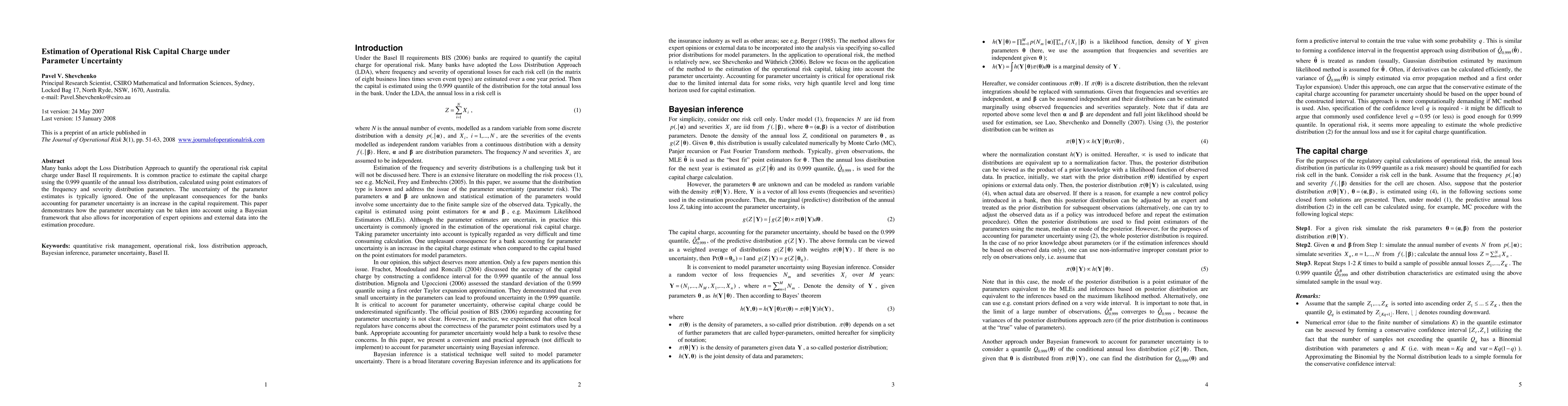

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)