Summary

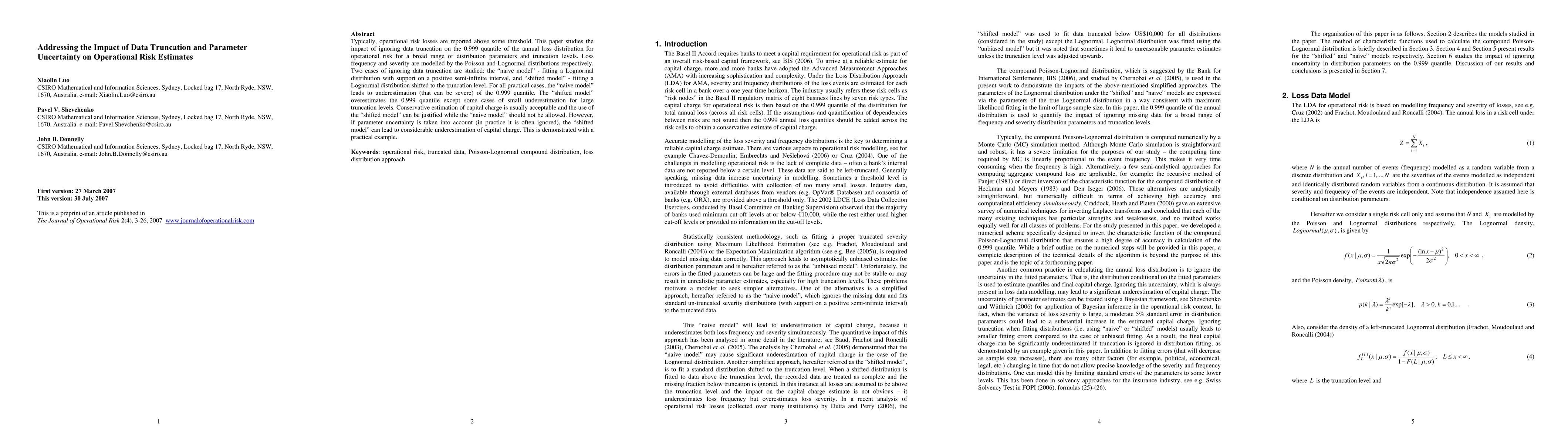

Typically, operational risk losses are reported above some threshold. This paper studies the impact of ignoring data truncation on the 0.999 quantile of the annual loss distribution for operational risk for a broad range of distribution parameters and truncation levels. Loss frequency and severity are modelled by the Poisson and Lognormal distributions respectively. Two cases of ignoring data truncation are studied: the "naive model" - fitting a Lognormal distribution with support on a positive semi-infinite interval, and "shifted model" - fitting a Lognormal distribution shifted to the truncation level. For all practical cases, the "naive model" leads to underestimation (that can be severe) of the 0.999 quantile. The "shifted model" overestimates the 0.999 quantile except some cases of small underestimation for large truncation levels. Conservative estimation of capital charge is usually acceptable and the use of the "shifted model" can be justified while the "naive model" should not be allowed. However, if parameter uncertainty is taken into account (in practice it is often ignored), the "shifted model" can lead to considerable underestimation of capital charge. This is demonstrated with a practical example.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)