Summary

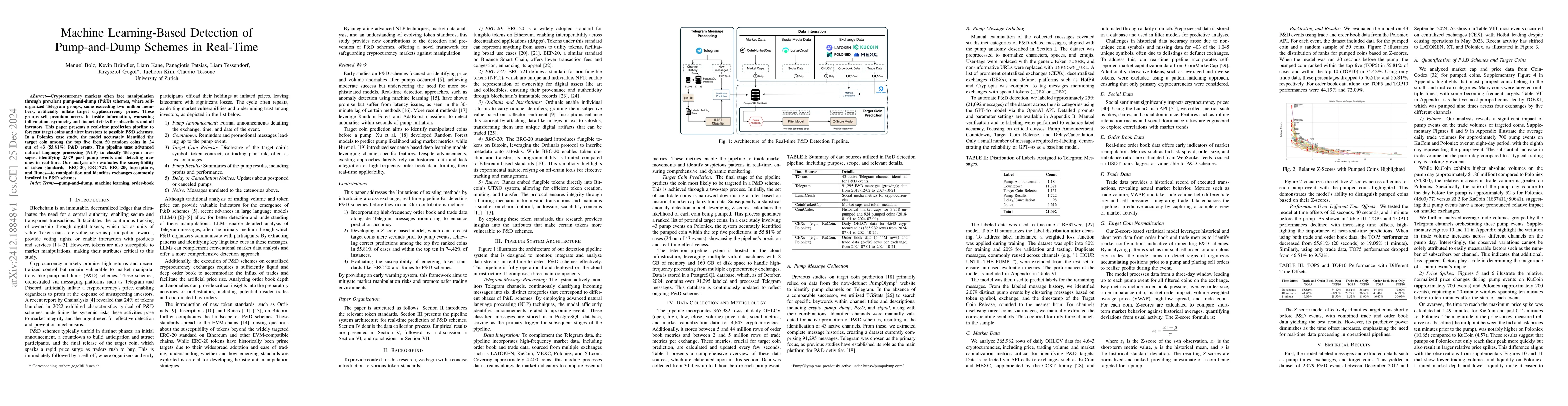

Cryptocurrency markets often face manipulation through prevalent pump-and-dump (P&D) schemes, where self-organized Telegram groups, some exceeding two million members, artificially inflate target cryptocurrency prices. These groups sell premium access to inside information, worsening information asymmetry and financial risks for subscribers and all investors. This paper presents a real-time prediction pipeline to forecast target coins and alert investors to possible P&D schemes. In a Poloniex case study, the model accurately identified the target coin among the top five from 50 random coins in 24 out of 43 (55.81%) P&D events. The pipeline uses advanced natural language processing (NLP) to classify Telegram messages, identifying 2,079 past pump events and detecting new ones in real-time. Our analysis also evaluates the susceptibility of token standards - ERC-20, ERC-721, BRC-20, Inscriptions, and Runes - to manipulation and identifies exchanges commonly involved in P&D schemes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCrypto Pump and Dump Detection via Deep Learning Techniques

Viswanath Chadalapaka, Gireesh Mahajan, Kyle Chang et al.

\textsc{Perseus}: Tracing the Masterminds Behind Cryptocurrency Pump-and-Dump Schemes

Jiahua Xu, Yebo Feng, Cong Wu et al.

Pump, Dump, and then What? The Long-Term Impact of Cryptocurrency Pump-and-Dump Schemes

Matthew Edwards, Joshua Clough

| Title | Authors | Year | Actions |

|---|

Comments (0)