Summary

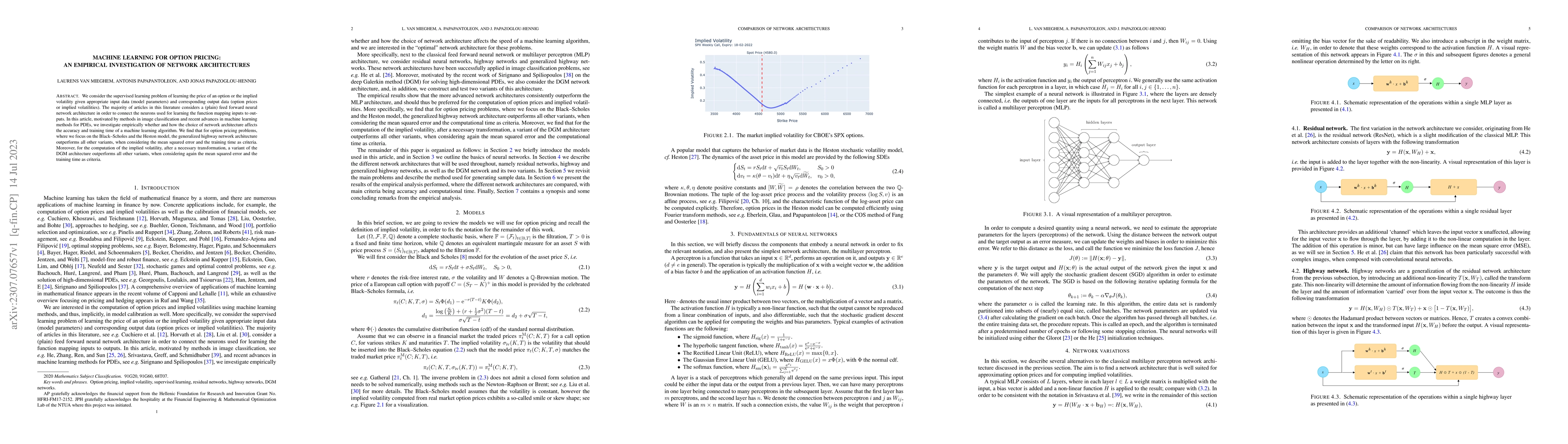

We consider the supervised learning problem of learning the price of an option or the implied volatility given appropriate input data (model parameters) and corresponding output data (option prices or implied volatilities). The majority of articles in this literature considers a (plain) feed forward neural network architecture in order to connect the neurons used for learning the function mapping inputs to outputs. In this article, motivated by methods in image classification and recent advances in machine learning methods for PDEs, we investigate empirically whether and how the choice of network architecture affects the accuracy and training time of a machine learning algorithm. We find that for option pricing problems, where we focus on the Black--Scholes and the Heston model, the generalized highway network architecture outperforms all other variants, when considering the mean squared error and the training time as criteria. Moreover, for the computation of the implied volatility, after a necessary transformation, a variant of the DGM architecture outperforms all other variants, when considering again the mean squared error and the training time as criteria.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMachine Learning-powered Pricing of the Multidimensional Passport Option

Josef Teichmann, Hanna Wutte

Neural Network Learning of Black-Scholes Equation for Option Pricing

Daniel de Souza Santos, Tiago Alessandro Espinola Ferreira

Error Analysis of Option Pricing via Deep PDE Solvers: Empirical Study

Masanori Hirano, Rawin Assabumrungrat, Kentaro Minami

| Title | Authors | Year | Actions |

|---|

Comments (0)