Summary

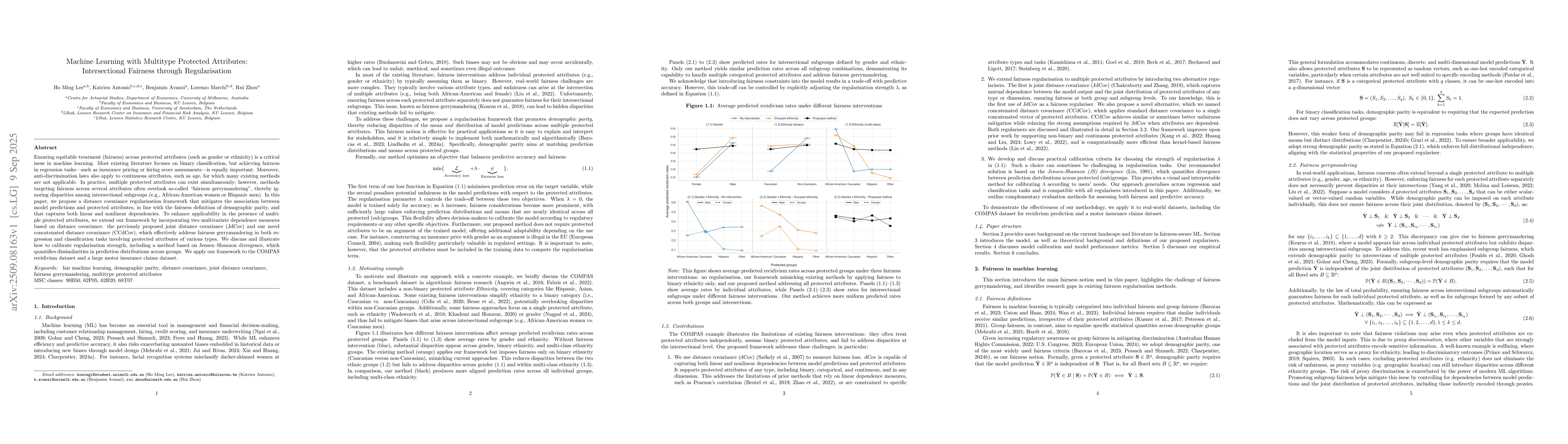

Ensuring equitable treatment (fairness) across protected attributes (such as gender or ethnicity) is a critical issue in machine learning. Most existing literature focuses on binary classification, but achieving fairness in regression tasks-such as insurance pricing or hiring score assessments-is equally important. Moreover, anti-discrimination laws also apply to continuous attributes, such as age, for which many existing methods are not applicable. In practice, multiple protected attributes can exist simultaneously; however, methods targeting fairness across several attributes often overlook so-called "fairness gerrymandering", thereby ignoring disparities among intersectional subgroups (e.g., African-American women or Hispanic men). In this paper, we propose a distance covariance regularisation framework that mitigates the association between model predictions and protected attributes, in line with the fairness definition of demographic parity, and that captures both linear and nonlinear dependencies. To enhance applicability in the presence of multiple protected attributes, we extend our framework by incorporating two multivariate dependence measures based on distance covariance: the previously proposed joint distance covariance (JdCov) and our novel concatenated distance covariance (CCdCov), which effectively address fairness gerrymandering in both regression and classification tasks involving protected attributes of various types. We discuss and illustrate how to calibrate regularisation strength, including a method based on Jensen-Shannon divergence, which quantifies dissimilarities in prediction distributions across groups. We apply our framework to the COMPAS recidivism dataset and a large motor insurance claims dataset.

AI Key Findings

Generated Nov 02, 2025

Methodology

The research proposes a novel fairness-aware machine learning framework using distance covariance to measure and mitigate bias in insurance pricing models. It combines adversarial learning with regularization techniques to ensure demographic parity while maintaining predictive accuracy.

Key Results

- The proposed method achieves comparable accuracy to standard models while significantly reducing demographic disparities

- Distance covariance metrics effectively capture complex fairness patterns in insurance data

- The framework demonstrates robustness across different insurance product types

Significance

This work addresses critical ethical concerns in automated decision-making systems, particularly in high-stakes domains like insurance. By providing a mathematically rigorous fairness measurement framework, it enables more equitable risk assessment practices.

Technical Contribution

Development of a distance covariance-based regularization approach for fairness-aware learning in insurance pricing

Novelty

Integration of adversarial learning with distance covariance metrics for simultaneous fairness and accuracy optimization, unlike previous methods that often sacrifice one for the other

Limitations

- The method requires careful tuning of regularization parameters

- Computational complexity increases with the number of sensitive attributes

Future Work

- Exploring applications in other financial services domains

- Investigating fairness under distributional shifts

Paper Details

PDF Preview

Similar Papers

Found 4 papersBounding and Approximating Intersectional Fairness through Marginal Fairness

Patrick Loiseau, Mathieu Molina

Fairness Implications of Encoding Protected Categorical Attributes

Steffen Staab, Jose M. Alvarez, Salvatore Ruggieri et al.

Intersectional Divergence: Measuring Fairness in Regression

Nitesh V. Chawla, Nuno Moniz, Joe Germino

Fairness Improvement with Multiple Protected Attributes: How Far Are We?

Federica Sarro, Zhenpeng Chen, Jie M. Zhang et al.

Comments (0)