Summary

In general insurance companies, a correct estimation of liabilities plays a key role due to its impact on management and investing decisions. Since the Financial Crisis of 2007-2008 and the strengthening of regulation, the focus is not only on the total reserve but also on its variability, which is an indicator of the risk assumed by the company. Thus, measures that relate profitability with risk are crucial in order to understand the financial position of insurance firms. Taking advantage of the increasing computational power, this paper introduces a stochastic reserving model whose aim is to improve the performance of the traditional Mack's reserving model by applying an ensemble of Recurrent Neural Networks. The results demonstrate that blending traditional reserving models with deep and machine learning techniques leads to a more accurate assessment of general insurance liabilities.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

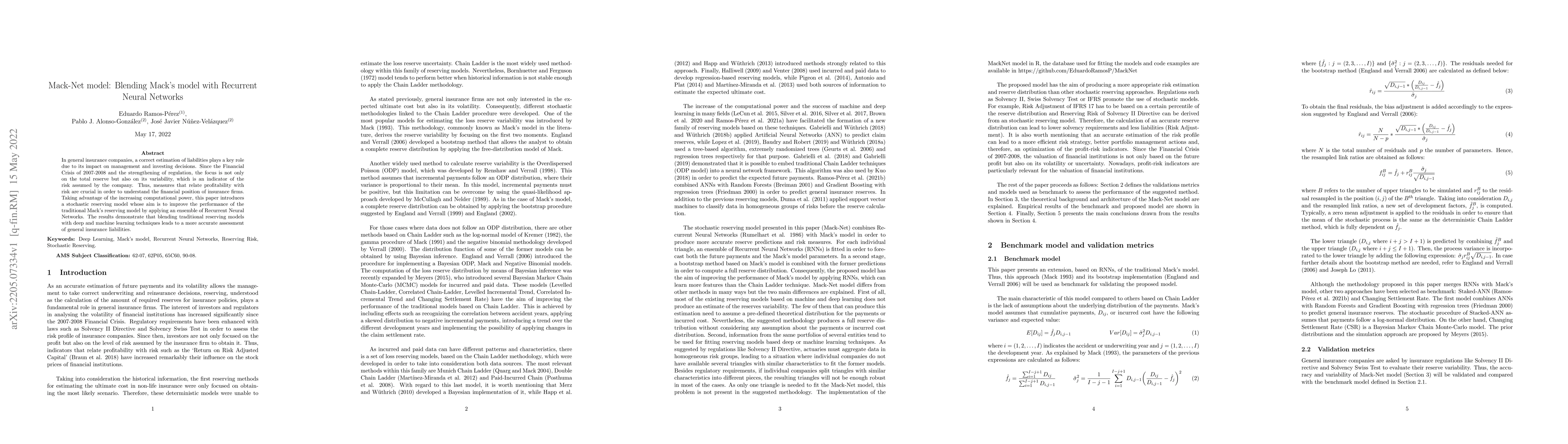

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMack's estimator motivated by large exposure asymptotics in a compound Poisson setting

Nils Engler, Filip Lindskog

No citations found for this paper.

Comments (0)