Authors

Summary

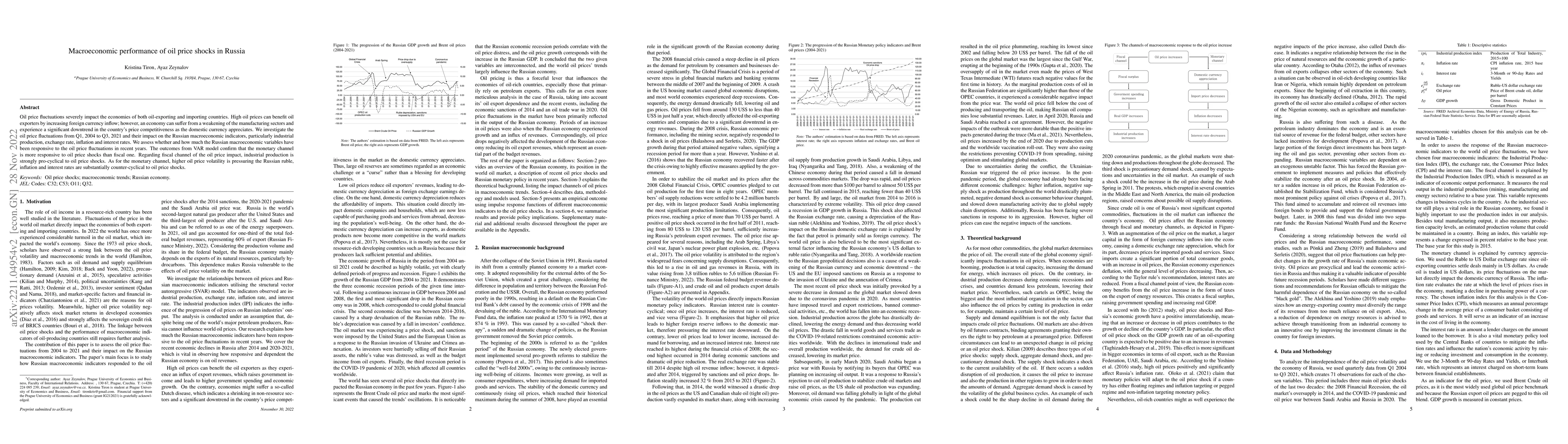

Oil price fluctuations severely impact the economies of both oil-exporting and importing countries. High oil prices can benefit oil exporters by increasing foreign currency inflow; however, an economy can suffer from a weakening of the manufacturing sectors and experience a significant downtrend in the country's price competitiveness as the domestic currency appreciates. We investigate the oil price fluctuations from Q1, 2004 to Q3, 2021 and their impact on the Russian macroeconomic indicators, particularly industrial production, exchange rate, inflation and interest rates. We assess whether and how much the Russian macroeconomic variables have been responsive to the oil price fluctuations in recent years. The outcomes from VAR model confirm that the monetary channel is more responsive to oil price shocks than the fiscal one. Regarding fiscal channel of the oil price impact, industrial production is strongly pro-cyclical to oil price shocks. As for the monetary channel, higher oil price volatility is pressuring the Russian ruble, inflation and interest rates are substantially counter-cyclical to oil price shocks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNot All Oil Price Shocks Are Alike. A Replication of Kilian (American Economic Review, 2009)

Rich Ryan, Nyakundi Michieka

Quantity restrictions and price discounts on Russian oil

Henrik Wachtmeister, Johan Gars, Daniel Spiro

| Title | Authors | Year | Actions |

|---|

Comments (0)