Authors

Summary

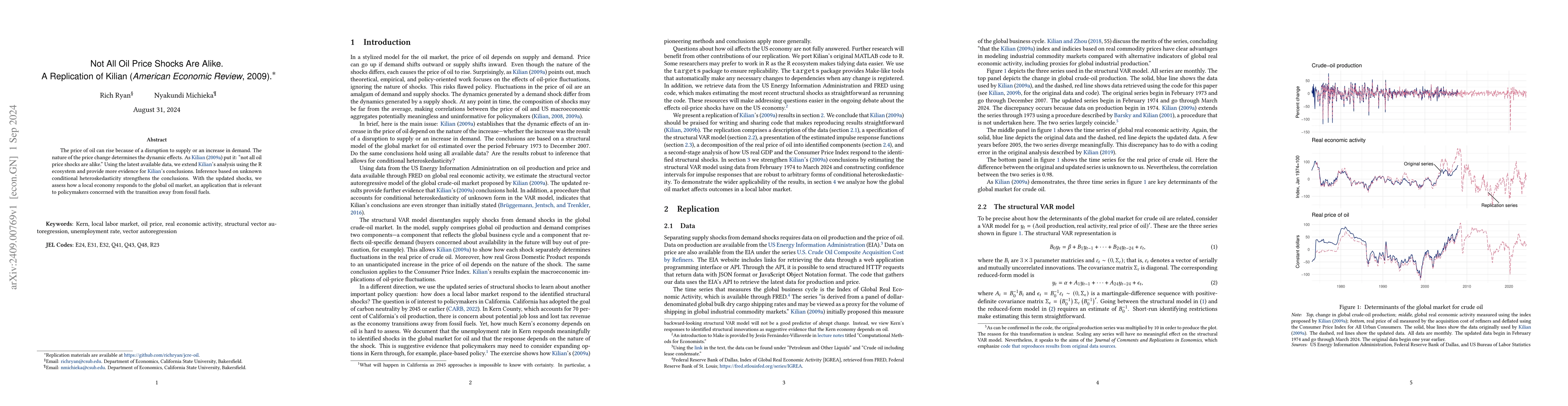

The price of oil can rise because of a disruption to supply or an increase in demand. The nature of the price change determines the dynamic effects. As Kilian (2009) put it: "not all oil price shocks are alike." Using the latest available data, we extend Kilian's (2009) analysis using the R ecosystem and provide more evidence for Kilian's (2009) conclusions. Inference based on unknown conditional heteroskedasticity strengthens the conclusions. With the updated shocks, we assess how a local economy responds to the global oil market, an application that is relevant to policymakers concerned with the transition away from fossil fuels.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)