Summary

We prove that the solution of the backward stochastic differential equation with terminal singularity has a Malliavin derivative, which is the limit of the derivative of the approximating sequence. We also provide the asymptotic behavior of this derivative close to the terminal time. We apply this result to the regularity of the related partial differential equation and to the sensitivity of the liquidation problem.

AI Key Findings

Generated Jun 08, 2025

Methodology

The paper proves the existence of the Malliavin derivative for the solution of a backward stochastic differential equation with terminal singularity, as the limit of the derivative of an approximating sequence.

Key Results

- Proves the Malliavin derivative exists for the solution of BSDE with terminal singularity.

- Establishes the asymptotic behavior of the Malliavin derivative near the terminal time.

Significance

This research contributes to the regularity analysis of the related PDE and the sensitivity study of optimal liquidation problems, which are crucial in quantitative finance.

Technical Contribution

The proof of the Malliavin derivative's existence for singular terminal value BSDEs and its asymptotic analysis near the terminal time.

Novelty

This work extends existing results on Malliavin calculus to a specific class of BSDEs with terminal singularities, providing new insights into liquidation problem sensitivity.

Limitations

- The paper does not address practical implications or applications in real-world trading scenarios.

- Limited discussion on computational methods for implementing the theoretical findings.

Future Work

- Investigate numerical methods for approximating Malliavin derivatives in liquidation problems.

- Explore extensions to more complex market models and trading constraints.

Paper Details

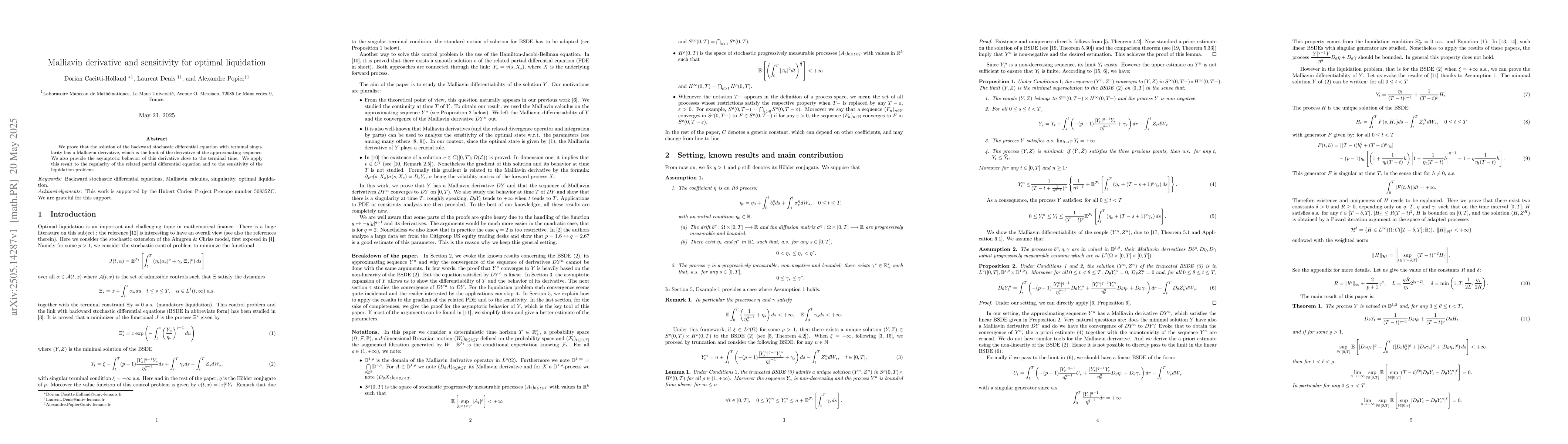

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)