Summary

This paper studies the risk-adjusted optimal timing to liquidate an option at the prevailing market price. In addition to maximizing the expected discounted return from option sale, we incorporate a path-dependent risk penalty based on shortfall or quadratic variation of the option price up to the liquidation time. We establish the conditions under which it is optimal to immediately liquidate or hold the option position through expiration. Furthermore, we study the variational inequality associated with the optimal stopping problem, and prove the existence and uniqueness of a strong solution. A series of analytical and numerical results are provided to illustrate the non-trivial optimal liquidation strategies under geometric Brownian motion (GBM) and exponential Ornstein-Uhlenbeck models. We examine the combined effects of price dynamics and risk penalty on the sell and delay regions for various options. In addition, we obtain an explicit closed-form solution for the liquidation of a stock with quadratic penalty under the GBM model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

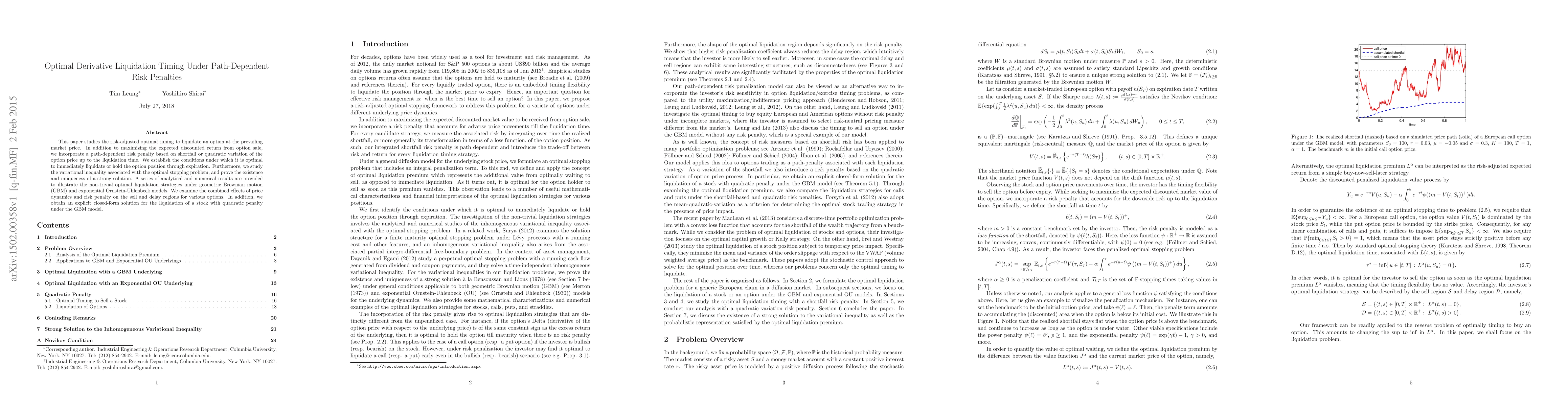

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMalliavin derivative and sensitivity for optimal liquidation

Alexandre Popier, Laurent Denis, Dorian Cacitti-Holland

| Title | Authors | Year | Actions |

|---|

Comments (0)