Summary

We study an optimal liquidation problem under the ambiguity with respect to price impact parameters. Our main results show that the value function and the optimal trading strategy can be characterized by the solution to a semi-linear PDE with superlinear gradient, monotone generator and singular terminal value. We also establish an asymptotic analysis of the robust model for small amount of uncertainty and analyse the effect of robustness on optimal trading strategies and liquidation costs. In particular, in our model ambiguity aversion is observationally equivalent to increased risk aversion. This suggests that ambiguity aversion increases liquidation rates.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

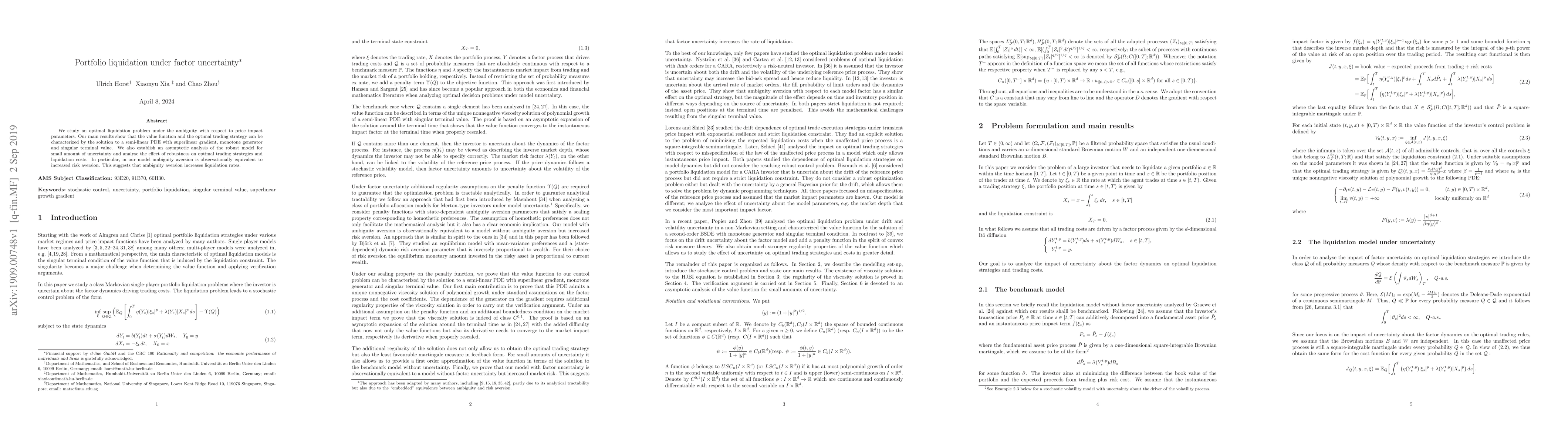

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)