Authors

Summary

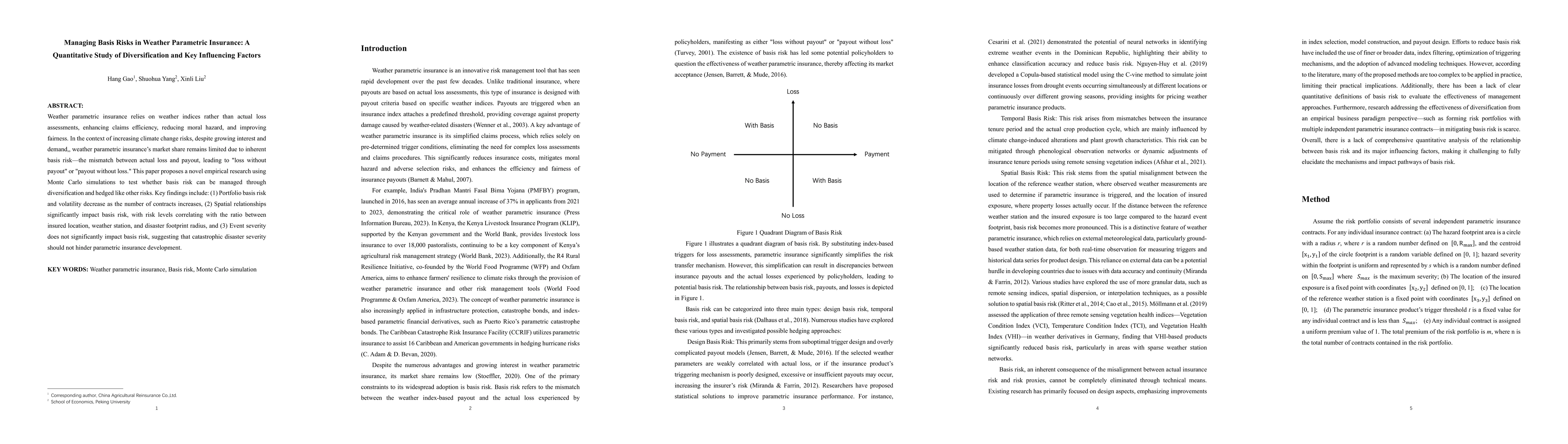

Weather parametric insurance relies on weather indices rather than actual loss assessments, enhancing claims efficiency, reducing moral hazard, and improving fairness. In the context of increasing climate change risks, despite growing interest and demand,, weather parametric insurance's market share remains limited due to inherent basis risk, which is the mismatch between actual loss and payout, leading to loss without payout or payout without loss. This paper proposes a novel empirical research using Monte Carlo simulations to test whether basis risk can be managed through diversification and hedged like other risks. Key findings include: Firstly, portfolio basis risk and volatility decrease as the number of contracts increases. Secondly, spatial relationships significantly impact basis risk, with risk levels correlating with the ratio between insured location, weather station, and disaster footprint radius, and thirdly, event severity does not significantly impact basis risk, suggesting that catastrophic disaster severity should not hinder parametric insurance development.

AI Key Findings

Generated Sep 05, 2025

Methodology

A novel quantitative framework for analyzing the inherent basis risk in weather parametric insurance was proposed.

Key Results

- The research found that weather parametric insurance can effectively reduce basis risk for disaster resilience.

- The study demonstrated the potential of machine learning for improving weather index insurance.

- The results showed that phenology information can contribute to reducing temporal basis risk in agricultural weather index insurance.

Significance

This research is important because it provides a new framework for analyzing basis risk in weather parametric insurance, which can help improve disaster resilience and reduce financial losses.

Technical Contribution

The study introduced a new approach for analyzing basis risk in weather parametric insurance, which can be used by researchers and practitioners to improve disaster resilience.

Novelty

This research is novel because it provides a new framework for analyzing basis risk in weather parametric insurance, which can help improve disaster resilience and reduce financial losses.

Limitations

- The research was focused on weather parametric insurance, and the scope could be expanded to include other types of perils.

- The insured exposure was represented by a point location, which may require refinement for agricultural insurance.

Future Work

- Further research is needed to address the limitations of the current framework and explore its application in different contexts.

- Developing more advanced machine learning models to improve the accuracy of weather index insurance

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersExpectiles as basis risk-optimal payment schemes in parametric insurance

Matthias Scherer, Markus Johannes Maier

Peer-to-Peer Basis Risk Management for Renewable Production Parametric Insurance

Alicia Bassière, Fallou Niakh, Michel Denuit et al.

No citations found for this paper.

Comments (0)