Summary

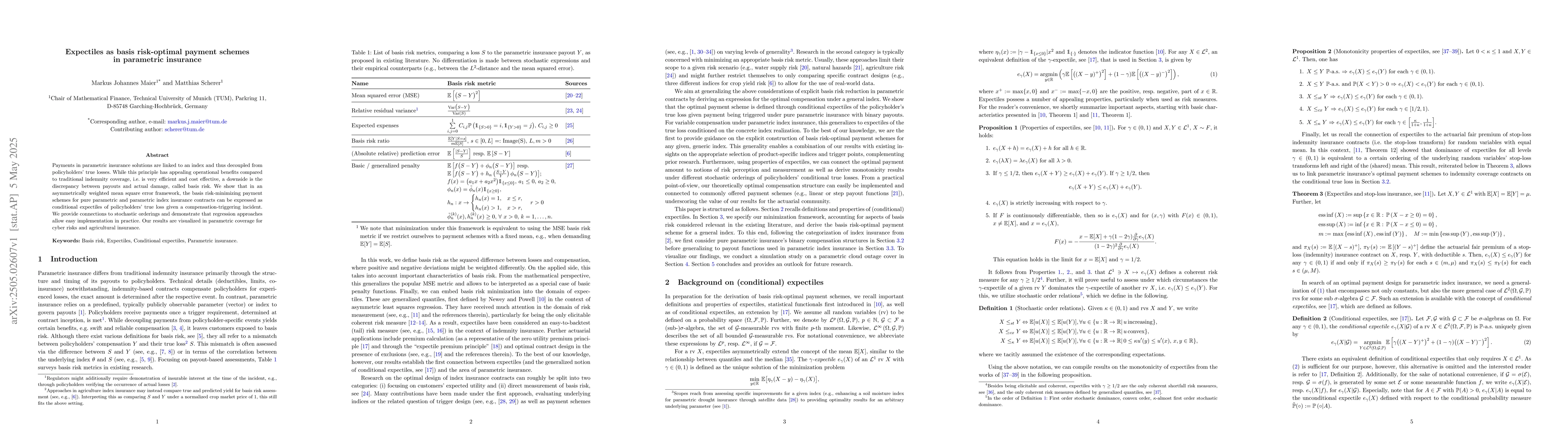

Payments in parametric insurance solutions are linked to an index and thus decoupled from policyholders' true losses. While this principle has appealing operational benefits compared to traditional indemnity coverage, i.e. is very efficient and cost effective, a downside is the discrepancy between payouts and actual damage, called basis risk. We show that in an asymmetrically weighted mean square error framework, the basis risk-minimizing payment schemes for pure parametric and parametric index insurance contracts can be expressed as conditional expectiles of policyholders' true loss given a compensation-triggering incident. We provide connections to stochastic orderings and demonstrate that regression approaches allow easy implementation in practice. Our results are visualized in parametric coverage for cyber risks and agricultural insurance.

AI Key Findings

Generated May 28, 2025

Methodology

The research employs an asymmetric mean square error framework to analyze basis risk in parametric insurance, deriving payment schemes as conditional expectiles of true losses given a triggering incident.

Key Results

- Basis risk-minimizing payment schemes for pure parametric and parametric index insurance can be expressed as conditional expectiles.

- Regression approaches allow for practical implementation of these schemes.

- Results are visualized for cyber risks and agricultural insurance.

- The framework connects to stochastic orderings and provides a theoretical basis for minimizing basis risk.

Significance

This study is significant as it offers a novel approach to minimize basis risk in parametric insurance, which is a major obstacle to its implementation and acceptance.

Technical Contribution

The paper introduces a quantification framework for basis risk minimization through asymmetric weighting of positive and negative squared differences between true losses and payouts, transferring the problem to the domain of conditional expectiles.

Novelty

This work is novel as it provides the first analytic expression for the optimal design of basis risk-minimizing payment schemes under a generic index, contrasting with existing research focused on specific risk scenarios.

Limitations

- The study assumes the relative importance of negative basis risk is known, which might be overly optimistic in practical applications.

- Current measurement of basis risk only considers absolute differences between losses and payments, neglecting relative deviations.

- Previous research on parametric contract design could be revisited under this framework for potential alignment with the minimization approach.

Future Work

- Investigate methods to reduce uncertainty in the approach, possibly drawing from behavior insurance ideas.

- Explore incorporating relative deviations in basis risk measurement alongside absolute differences.

- Revisit existing parametric contract design results using this framework to align with the minimization approach.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPeer-to-Peer Basis Risk Management for Renewable Production Parametric Insurance

Alicia Bassière, Fallou Niakh, Michel Denuit et al.

Optimal index insurance and basis risk decomposition: an application to Kenya

David Lobell, Matthieu Stigler

No citations found for this paper.

Comments (0)