Authors

Summary

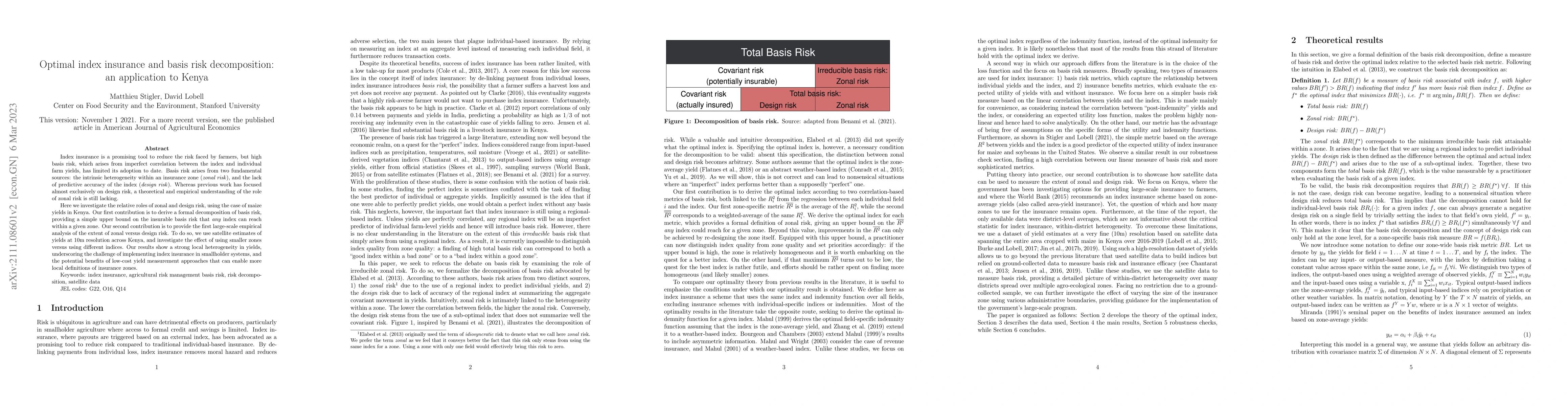

Index insurance is a promising tool to reduce the risk faced by farmers, but high basis risk, which arises from imperfect correlation between the index and individual farm yields, has limited its adoption to date. Basis risk arises from two fundamental sources: the intrinsic heterogeneity within an insurance zone (zonal risk), and the lack of predictive accuracy of the index (design risk). Whereas previous work has focused almost exclusively on design risk, a theoretical and empirical understanding of the role of zonal risk is still lacking. Here we investigate the relative roles of zonal and design risk, using the case of maize yields in Kenya. Our first contribution is to derive a formal decomposition of basis risk, providing a simple upper bound on the insurable basis risk that any index can reach within a given zone. Our second contribution is to provide the first large-scale empirical analysis of the extent of zonal versus design risk. To do so, we use satellite estimates of yields at 10m resolution across Kenya, and investigate the effect of using smaller zones versus using different indices. Our results show a strong local heterogeneity in yields, underscoring the challenge of implementing index insurance in smallholder systems, and the potential benefits of low-cost yield measurement approaches that can enable more local definitions of insurance zones.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersWith big data come big problems: pitfalls in measuring basis risk for crop index insurance

Apratim Dey, David Lobell, Matthieu Stigler et al.

Expectiles as basis risk-optimal payment schemes in parametric insurance

Matthias Scherer, Markus Johannes Maier

Peer-to-Peer Basis Risk Management for Renewable Production Parametric Insurance

Alicia Bassière, Fallou Niakh, Michel Denuit et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)