Summary

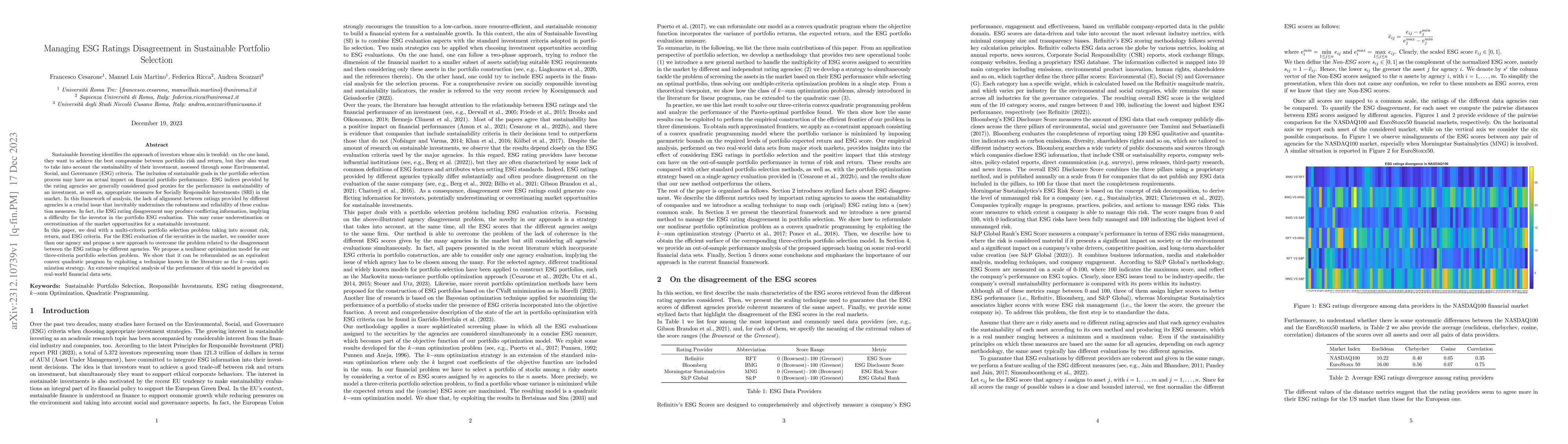

Sustainable Investing identifies the approach of investors whose aim is twofold: on the one hand, they want to achieve the best compromise between portfolio risk and return, but they also want to take into account the sustainability of their investment, assessed through some Environmental, Social, and Governance (ESG) criteria. The inclusion of sustainable goals in the portfolio selection process may have an actual impact on financial portfolio performance. ESG indices provided by the rating agencies are generally considered good proxies for the performance in sustainability of an investment, as well as, appropriate measures for Socially Responsible Investments (SRI) in the market. In this framework of analysis, the lack of alignment between ratings provided by different agencies is a crucial issue that inevitably undermines the robustness and reliability of these evaluation measures. In fact, the ESG rating disagreement may produce conflicting information, implying a difficulty for the investor in the portfolio ESG evaluation. This may cause underestimation or overestimation of the market opportunities for a sustainable investment. In this paper, we deal with a multi-criteria portfolio selection problem taking into account risk, return, and ESG criteria. For the ESG evaluation of the securities in the market, we consider more than one agency and propose a new approach to overcome the problem related to the disagreement between the ESG ratings by different agencies. We propose a nonlinear optimization model for our three-criteria portfolio selection problem. We show that it can be reformulated as an equivalent convex quadratic program by exploiting a technique known in the literature as the k-sum optimization strategy. An extensive empirical analysis of the performance of this model is provided on real-world financial data sets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersESG-Valued Portfolio Optimization and Dynamic Asset Pricing

W. Brent Lindquist, Svetlozar T. Rachev, Davide Lauria et al.

Crosswashing in Sustainable Investing: Unveiling Strategic Practices Impacting ESG Scores

Bertrand Kian Hassani, Yacoub Bahini

No citations found for this paper.

Comments (0)