Authors

Summary

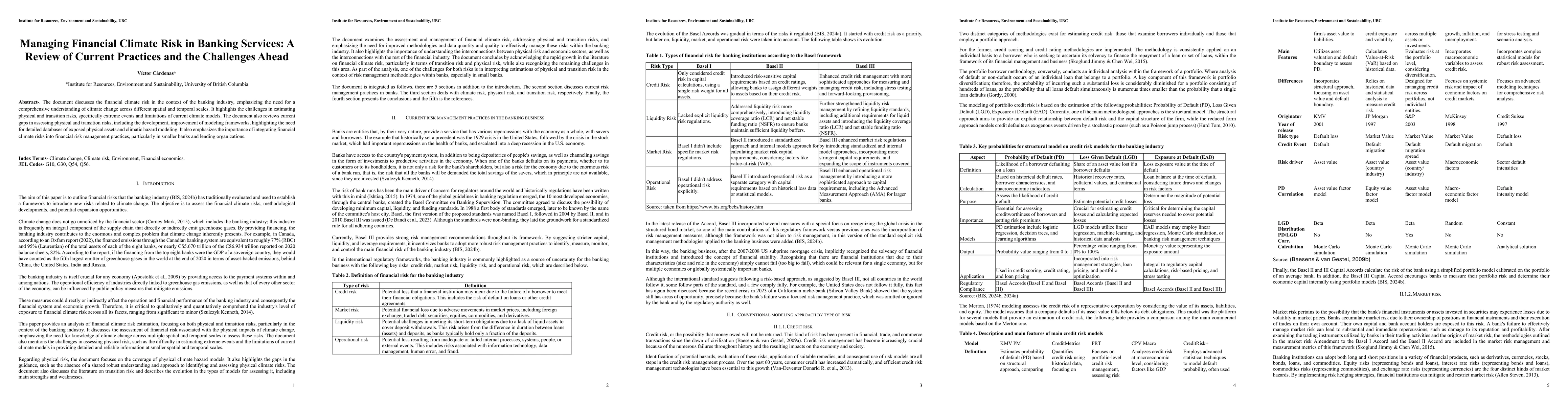

The document discusses the financial climate risk in the context of the banking industry, emphasizing the need for a comprehensive understanding of climate change across different spatial and temporal scales. It highlights the challenges in estimating physical and transition risks, specifically extreme events and limitations of current climate models. The document also reviews current gaps in assessing physical and transition risks, including the development, improvement of modeling frameworks, highlighting the need for detailed databases of exposed physical assets and climatic hazard modeling. It also emphasizes the importance of integrating financial climate risks into financial risk management practices, particularly in smaller banks and lending organizations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)