Summary

As markets have digitized, the number of tradable products has skyrocketed. Algorithmically constructed portfolios of these assets now dominate public and private markets, resulting in a combinatorial explosion of tradable assets. In this paper, we provide a simple means to compute market clearing prices for semi-fungible assets which have a partial ordering between them. Such assets are increasingly found in traditional markets (bonds, commodities, ETFs), private markets (private credit, compute markets), and in decentralized finance. We formulate the market clearing problem as an optimization problem over a directed acyclic graph that represents participant preferences. Subsequently, we use convex duality to efficiently estimate market clearing prices, which correspond to particular dual variables. We then describe dominant strategy incentive compatible payment and allocation rules for clearing these markets. We conclude with examples of how this framework can construct prices for a variety of algorithmically constructed, semi-fungible portfolios of practical importance.

AI Key Findings

Generated Jun 07, 2025

Methodology

The paper formulates the market clearing problem as an optimization problem over a directed acyclic graph representing participant preferences, using convex duality to efficiently estimate market clearing prices.

Key Results

- Provides a method to compute market clearing prices for semi-fungible assets with partial ordering.

- Describes dominant strategy incentive compatible payment and allocation rules for clearing markets.

Significance

This research is important for efficiently pricing algorithmically constructed, semi-fungible portfolios found in traditional, private, and decentralized finance markets.

Technical Contribution

The use of convex duality for efficiently estimating market clearing prices in semi-fungible asset markets.

Novelty

The paper introduces a novel approach to market clearing for semi-fungible assets, distinguishing itself from previous research focused on fully fungible assets.

Limitations

- The paper does not discuss potential scalability issues with increasing numbers of assets or participants.

- No mention of real-world testing or empirical validation of the proposed method.

Future Work

- Explore scalability of the proposed method for large-scale markets.

- Conduct empirical studies to validate the approach in real-world scenarios.

Paper Details

PDF Preview

Citation Network

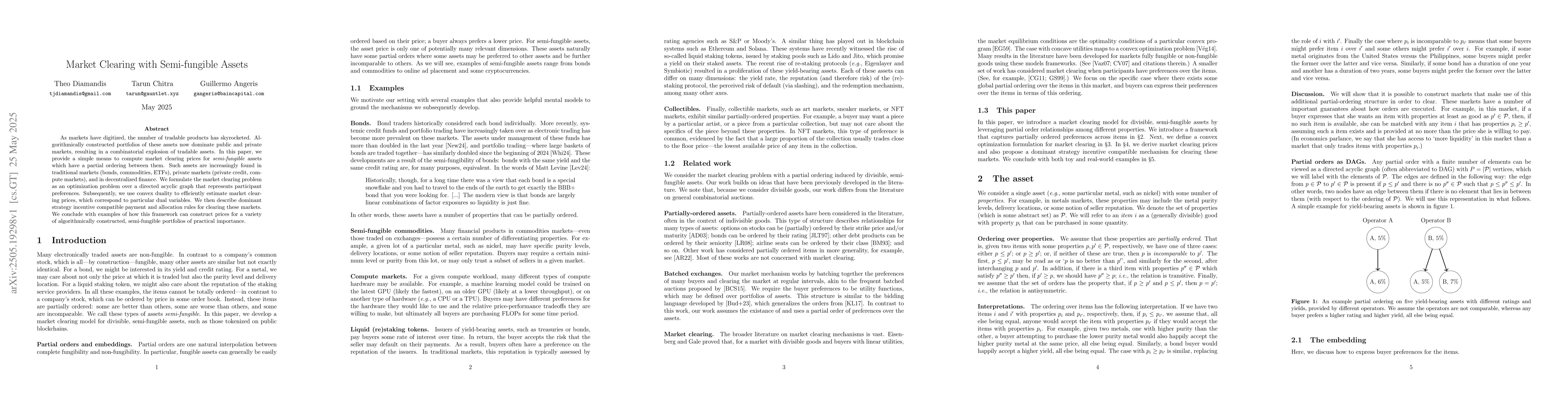

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersVirtual Linking Bids for Market Clearing with Non-Merchant Storage

Eléa Prat, Jonas Bodulv Broge, Richard Lusby

Patents and intellectual property assets as non-fungible tokens: key technologies and challenges

Qiang Qu, Seyed Mojtaba Hosseini Bamakan, Nasim Nezhadsistani et al.

Market Microstructure of Non Fungible Tokens

Kaushik Ghosh, Mayukh Mukhopadhyay

No citations found for this paper.

Comments (0)