Authors

Summary

It has been long that literature in financial academics focuses mainly on price and return but much less on trading volume. In the past twenty years, it has already linked both price and trading volume to economic fundamentals, and explored the behavioral implications of trading volume such as investor's attitude toward risks, overconfidence, disagreement, and attention etc. However, what is surprising is how little we really know about trading volume. Here we show that trading volume probability represents the frequency of market crowd's trading action in terms of behavior analysis, and test two adaptive hypotheses relevant to the volume uncertainty associated with price in China stock market. The empirical work reveals that market crowd trade a stock in efficient adaptation except for simple heuristics, gradually tend to achieve agreement on an outcome or an asset price widely on a trading day, and generate such a stationary equilibrium price very often in interaction and competition among themselves no matter whether it is highly overestimated or underestimated. This suggests that asset prices include not only a fundamental value but also private information, speculative, sentiment, attention, gamble, and entertainment values etc. Moreover, market crowd adapt to gain and loss by trading volume increase or decrease significantly in interaction with environment in any two consecutive trading days. Our results demonstrate how interaction between information and news, the trading action, and return outcomes in the three-term feedback loop produces excessive trading volume which includes various internal and external causes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

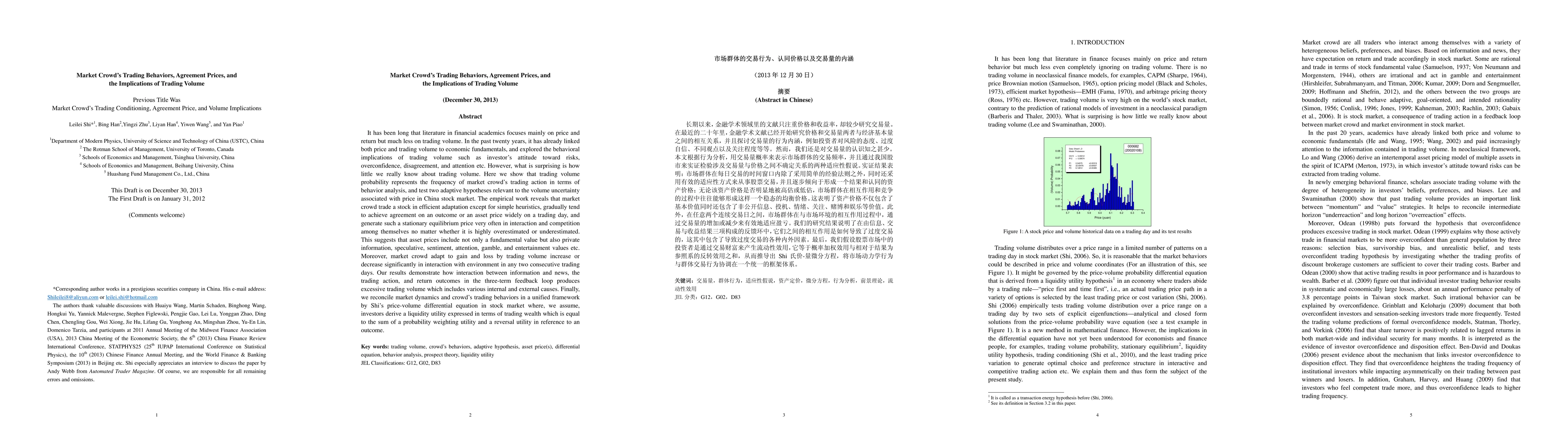

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAbnormal Trading Detection in the NFT Market

Yunsong Liu, Agam Shah, Sudheer Chava et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)