Summary

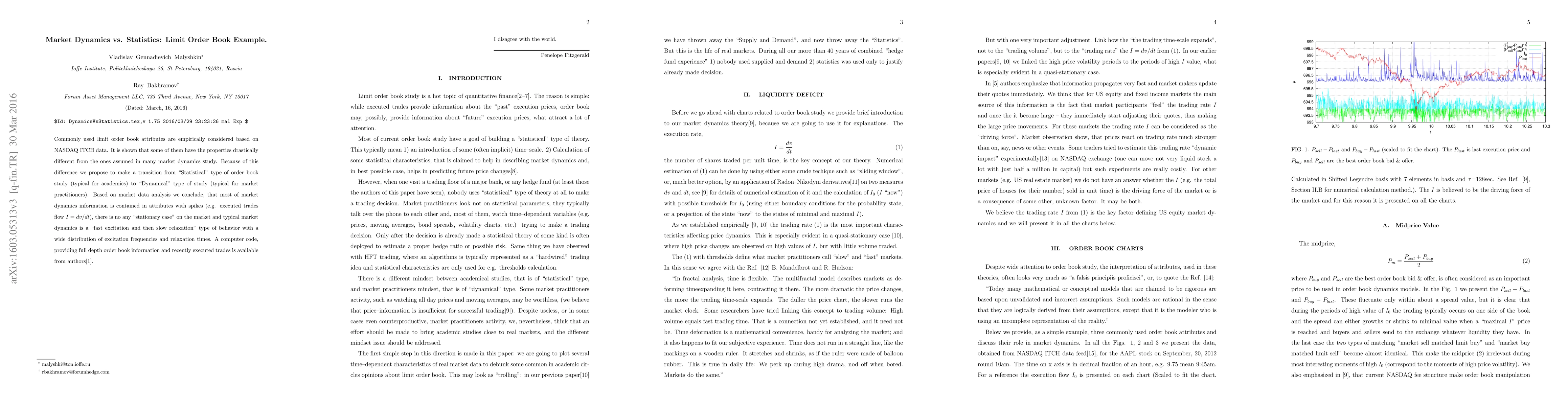

Commonly used limit order book attributes are empirically considered based on NASDAQ ITCH data. It is shown that some of them have the properties drastically different from the ones assumed in many market dynamics study. Because of this difference we propose to make a transition from "Statistical" type of order book study (typical for academics) to "Dynamical" type of study (typical for market practitioners). Based on market data analysis we conclude, that most of market dynamics information is contained in attributes with spikes (e.g. executed trades flow $I=dv/dt$), there is no any "stationary case" on the market and typical market dynamics is a "fast excitation and then slow relaxation" type of behavior with a wide distribution of excitation frequencies and relaxation times. A computer code, providing full depth order book information and recently executed trades is available from authors [1].

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)