Summary

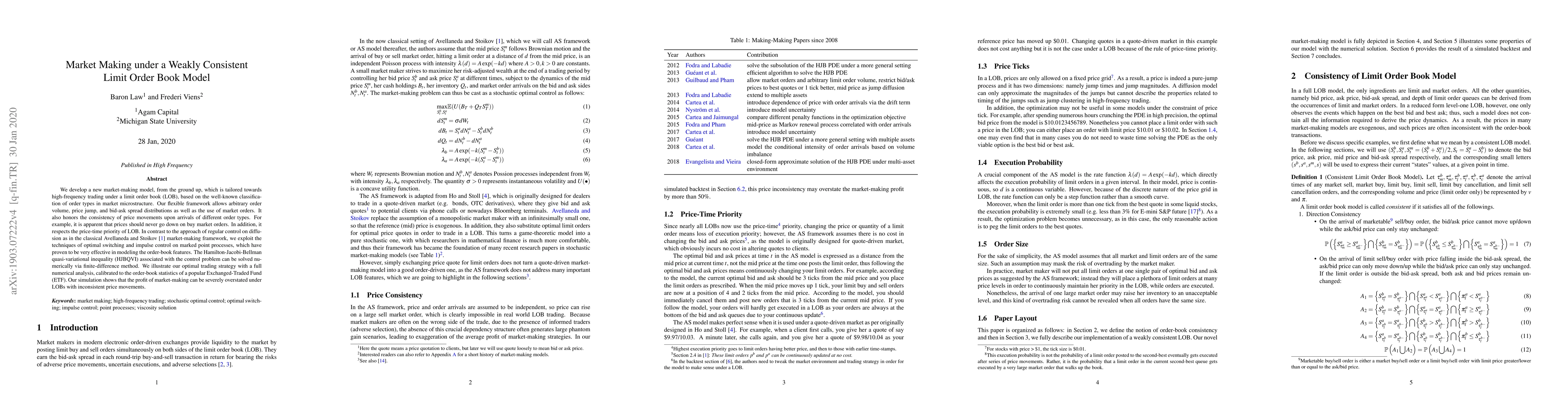

We develop a new market-making model, from the ground up, which is tailored towards high-frequency trading under a limit order book (LOB), based on the well-known classification of order types in market microstructure. Our flexible framework allows arbitrary order volume, price jump, and bid-ask spread distributions as well as the use of market orders. It also honors the consistency of price movements upon arrivals of different order types. For example, it is apparent that prices should never go down on buy market orders. In addition, it respects the price-time priority of LOB. In contrast to the approach of regular control on diffusion as in the classical Avellaneda and Stoikov [1] market-making framework, we exploit the techniques of optimal switching and impulse control on marked point processes, which have proven to be very effective in modeling the order-book features. The Hamilton-Jacobi-Bellman quasi-variational inequality (HJBQVI) associated with the control problem can be solved numerically via finite-difference method. We illustrate our optimal trading strategy with a full numerical analysis, calibrated to the order-book statistics of a popular Exchanged-Traded Fund (ETF). Our simulation shows that the profit of market-making can be severely overstated under LOBs with inconsistent price movements.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep Reinforcement Learning for Market Making Under a Hawkes Process-Based Limit Order Book Model

Zvonko Kostanjčar, Bruno Gašperov

Event-Based Limit Order Book Simulation under a Neural Hawkes Process: Application in Market-Making

Luca Lalor, Anatoliy Swishchuk

Reinforcement Learning-Based Market Making as a Stochastic Control on Non-Stationary Limit Order Book Dynamics

Rafael Zimmer, Oswaldo Luiz do Valle Costa

| Title | Authors | Year | Actions |

|---|

Comments (0)