Authors

Summary

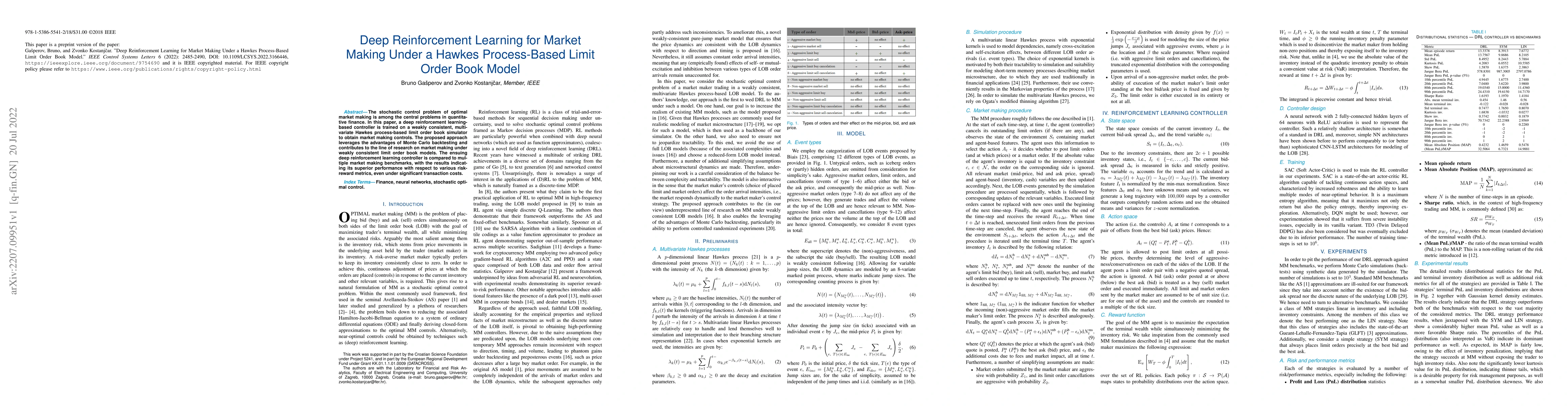

The stochastic control problem of optimal market making is among the central problems in quantitative finance. In this paper, a deep reinforcement learning-based controller is trained on a weakly consistent, multivariate Hawkes process-based limit order book simulator to obtain market making controls. The proposed approach leverages the advantages of Monte Carlo backtesting and contributes to the line of research on market making under weakly consistent limit order book models. The ensuing deep reinforcement learning controller is compared to multiple market making benchmarks, with the results indicating its superior performance with respect to various risk-reward metrics, even under significant transaction costs.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEvent-Based Limit Order Book Simulation under a Neural Hawkes Process: Application in Market-Making

Luca Lalor, Anatoliy Swishchuk

Reinforcement Learning-Based Market Making as a Stochastic Control on Non-Stationary Limit Order Book Dynamics

Rafael Zimmer, Oswaldo Luiz do Valle Costa

| Title | Authors | Year | Actions |

|---|

Comments (0)