Summary

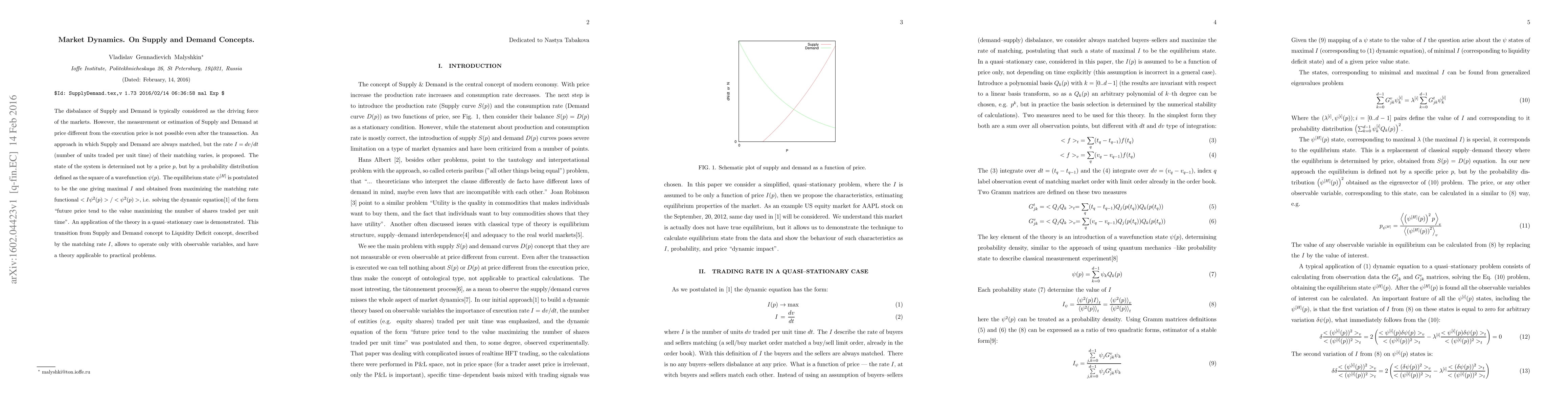

The disbalance of Supply and Demand is typically considered as the driving

force of the markets. However, the measurement or estimation of Supply and

Demand at price different from the execution price is not possible even after

the transaction. An approach in which Supply and Demand are always matched, but

the rate $I=dv/dt$ (number of units traded per unit time) of their matching

varies, is proposed. The state of the system is determined not by a price $p$,

but by a probability distribution defined as the square of a wavefunction

$\psi(p)$. The equilibrium state $\psi^{[H]}$ is postulated to be the one

giving maximal $I$ and obtained from maximizing the matching rate functional

$

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBullwhip Effect of Supply Networks: Joint Impact of Network Structure and Market Demand

Jianxi Gao, Chencheng Cai, Jin-Zhu Yü

News ecosystem dynamics: Supply, Demand, Diffusion, and the role of Disinformation

Emanuele Brugnoli, Pietro Gravino, Giulio Prevedello

| Title | Authors | Year | Actions |

|---|

Comments (0)