Summary

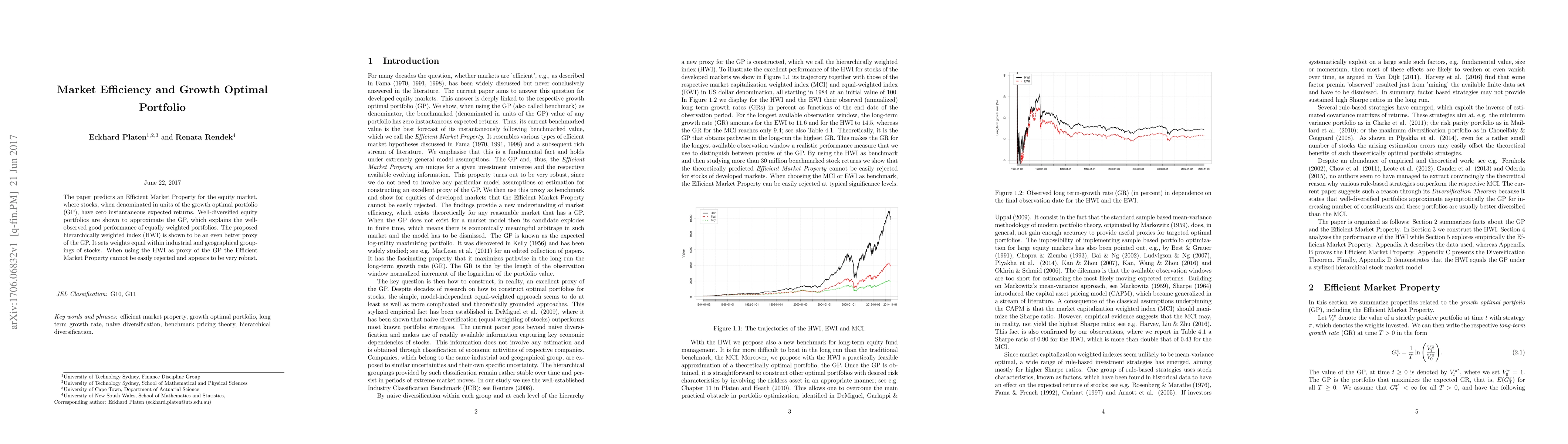

The paper predicts an Efficient Market Property for the equity market, where stocks, when denominated in units of the growth optimal portfolio (GP), have zero instantaneous expected returns. Well-diversified equity portfolios are shown to approximate the GP, which explains the well-observed good performance of equally weighted portfolios. The proposed hierarchically weighted index (HWI) is shown to be an even better proxy of the GP. It sets weights equal within industrial and geographical groupings of stocks. When using the HWI as proxy of the GP the Efficient Market Property cannot be easily rejected and appears to be very robust.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)