Summary

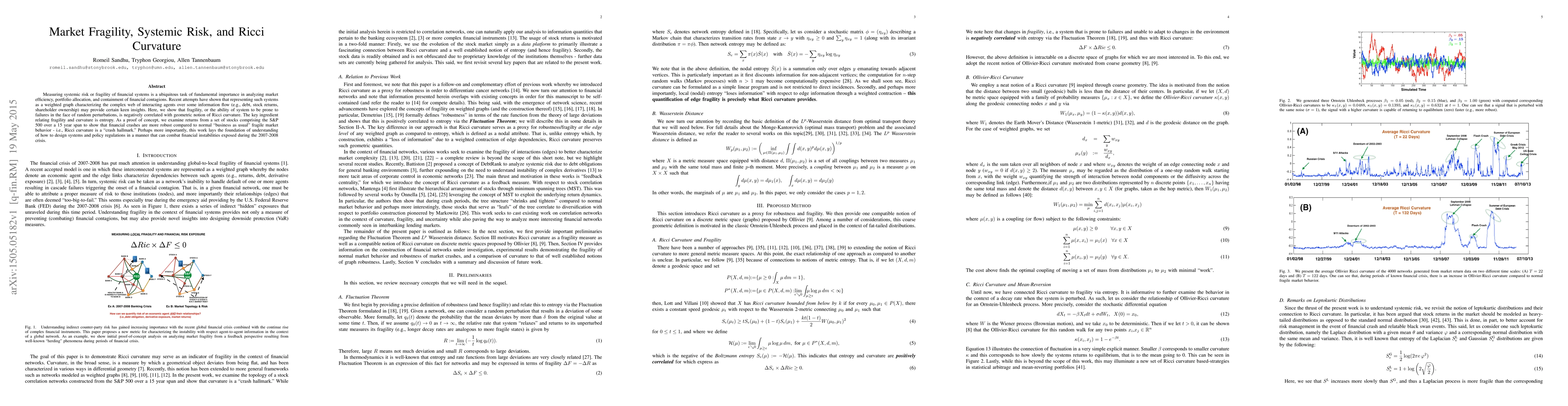

Measuring systemic risk or fragility of financial systems is a ubiquitous task of fundamental importance in analyzing market efficiency, portfolio allocation, and containment of financial contagions. Recent attempts have shown that representing such systems as a weighted graph characterizing the complex web of interacting agents over some information flow (e.g., debt, stock returns, shareholder ownership) may provide certain keen insights. Here, we show that fragility, or the ability of system to be prone to failures in the face of random perturbations, is negatively correlated with geometric notion of Ricci curvature. The key ingredient relating fragility and curvature is entropy. As a proof of concept, we examine returns from a set of stocks comprising the S\&P 500 over a 15 year span to show that financial crashes are more robust compared to normal "business as usual" fragile market behavior - i.e., Ricci curvature is a "crash hallmark." Perhaps more importantly, this work lays the foundation of understanding of how to design systems and policy regulations in a manner that can combat financial instabilities exposed during the 2007-2008 crisis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStability of China's Stock Market: Measure and Forecast by Ricci Curvature on Network

Liang Zhao, Ning Zhang, Xinyu Wang et al.

On the Ollivier-Ricci curvature as fragility indicator of the stock markets

Joaquín Sánchez García, Sebastian Gherghe

| Title | Authors | Year | Actions |

|---|

Comments (0)