Summary

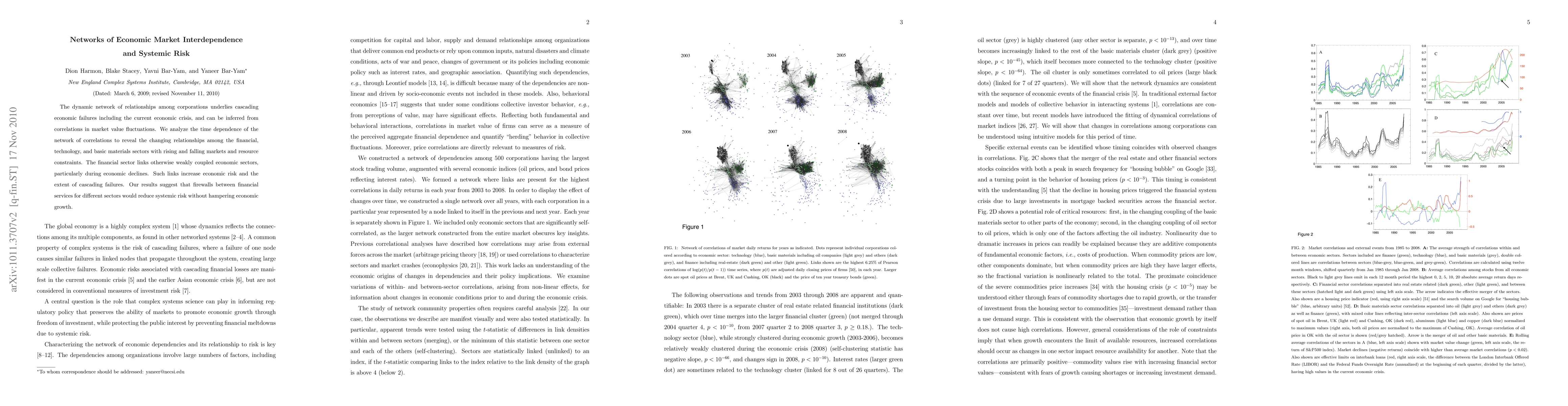

The dynamic network of relationships among corporations underlies cascading economic failures including the current economic crisis, and can be inferred from correlations in market value fluctuations. We analyze the time dependence of the network of correlations to reveal the changing relationships among the financial, technology, and basic materials sectors with rising and falling markets and resource constraints. The financial sector links otherwise weakly coupled economic sectors, particularly during economic declines. Such links increase economic risk and the extent of cascading failures. Our results suggest that firewalls between financial services for different sectors would reduce systemic risk without hampering economic growth.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)