Summary

We address a fundamental problem that is systematically encountered when modeling complex systems: the limitedness of the information available. In the case of economic and financial networks, privacy issues severely limit the information that can be accessed and, as a consequence, the possibility of correctly estimating the resilience of these systems to events such as financial shocks, crises and cascade failures. Here we present an innovative method to reconstruct the structure of such partially-accessible systems, based on the knowledge of intrinsic node-specific properties and of the number of connections of only a limited subset of nodes. This information is used to calibrate an inference procedure based on fundamental concepts derived from statistical physics, which allows to generate ensembles of directed weighted networks intended to represent the real system, so that the real network properties can be estimated with their average values within the ensemble. Here we test the method both on synthetic and empirical networks, focusing on the properties that are commonly used to measure systemic risk. Indeed, the method shows a remarkable robustness with respect to the limitedness of the information available, thus representing a valuable tool for gaining insights on privacy-protected economic and financial systems.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

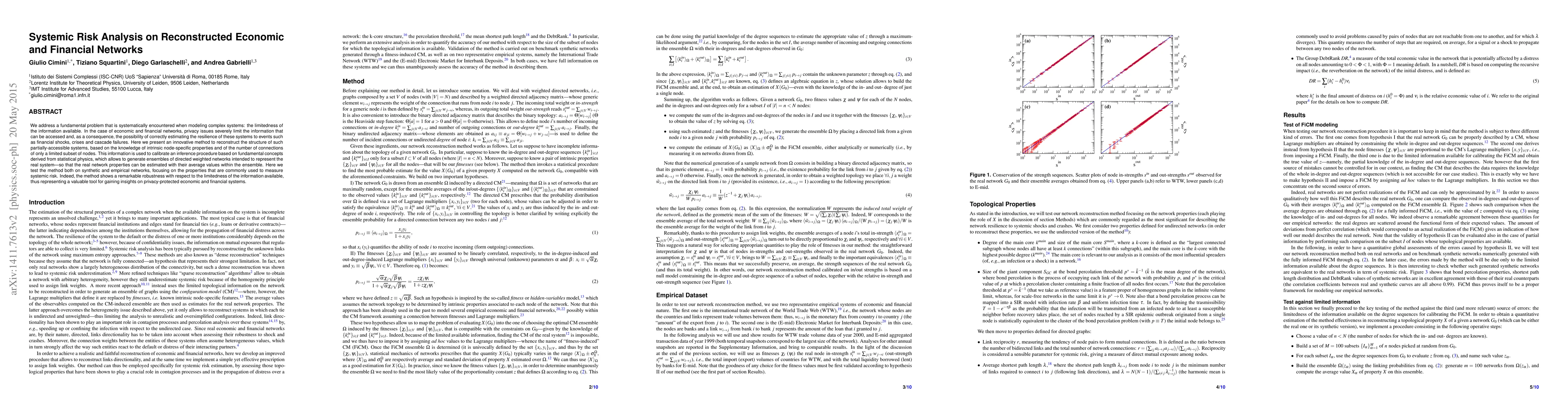

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)