Summary

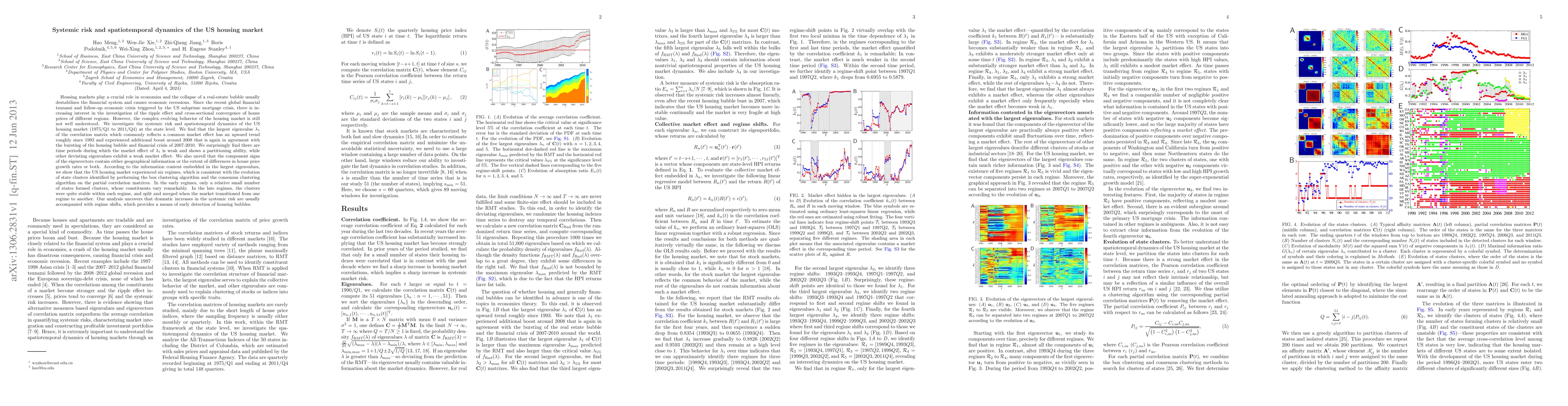

Housing markets play a crucial role in economies and the collapse of a real-estate bubble usually destabilizes the financial system and causes economic recessions. We investigate the systemic risk and spatiotemporal dynamics of the US housing market (1975-2011) at the state level based on the Random Matrix Theory (RMT). We identify rich economic information in the largest eigenvalues deviating from RMT predictions and unveil that the component signs of the eigenvectors contain either geographical information or the extent of differences in house price growth rates or both. Our results show that the US housing market experienced six different regimes, which is consistent with the evolution of state clusters identified by the box clustering algorithm and the consensus clustering algorithm on the partial correlation matrices. Our analysis uncovers that dramatic increases in the systemic risk are usually accompanied with regime shifts, which provides a means of early detection of housing bubbles.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)