Summary

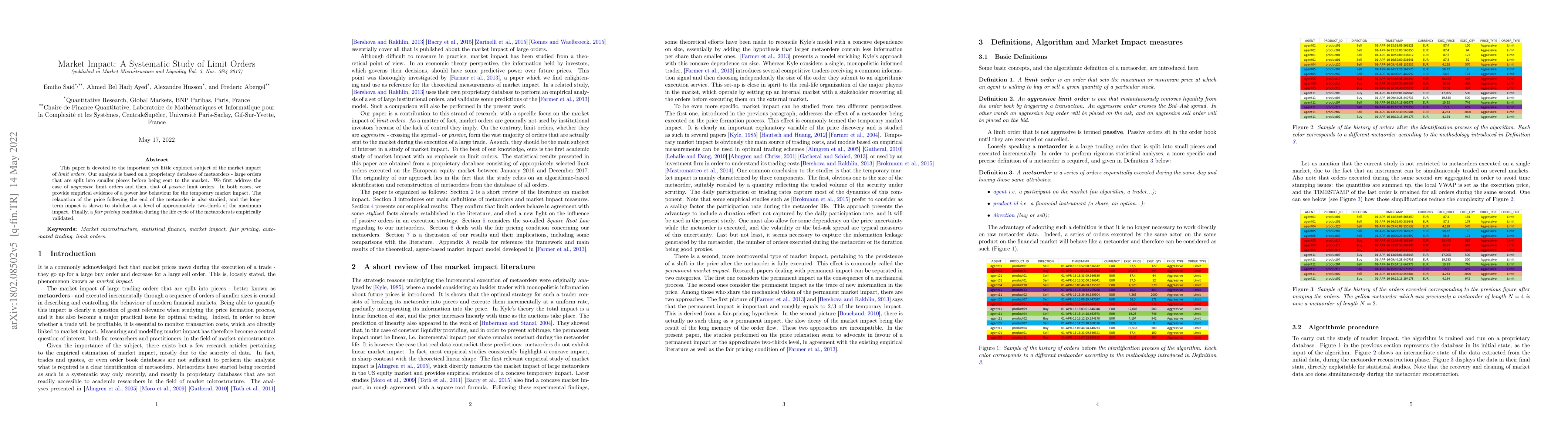

This paper is devoted to the important yet little explored subject of the market impact of limit orders. Our analysis is based on a proprietary database of metaorders - large orders that are split into smaller pieces before being sent to the market. We first address the case of aggressive limit orders and then, that of passive limit orders. In both cases, we provide empirical evidence of a power law behaviour for the temporary market impact. The relaxation of the price following the end of the metaorder is also studied, and the long-term impact is shown to stabilize at a level of approximately two-thirds of the maximum impact. Finally, a fair pricing condition during the life cycle of the metaorders is empirically validated.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMarket Impact: A Systematic Study of the High Frequency Options Market

Emilio Said, Ahmed Bel Hadj Ayed, Damien Thillou et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)