Summary

This paper deals with a fundamental subject that has seldom been addressed in recent years, that of market impact in the options market. Our analysis is based on a proprietary database of metaorders-large orders that are split into smaller pieces before being sent to the market on one of the main Asian markets. In line with our previous work on the equity market [Said et al., 2018], we propose an algorithmic approach to identify metaorders, based on some implied volatility parameters, the at the money forward volatility and at the money forward skew. In both cases, we obtain results similar to the now well understood equity market: Square-root law, Fair Pricing Condition and Market Impact Dynamics.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

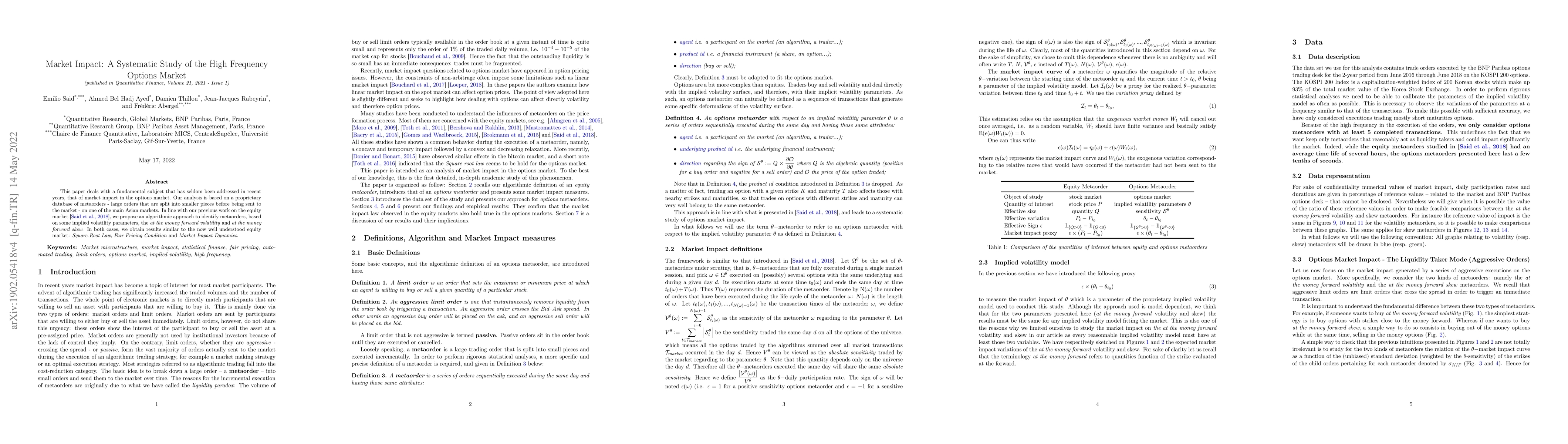

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMarket Impact: A Systematic Study of Limit Orders

Emilio Said, Ahmed Bel Hadj Ayed, Frédéric Abergel et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)