Summary

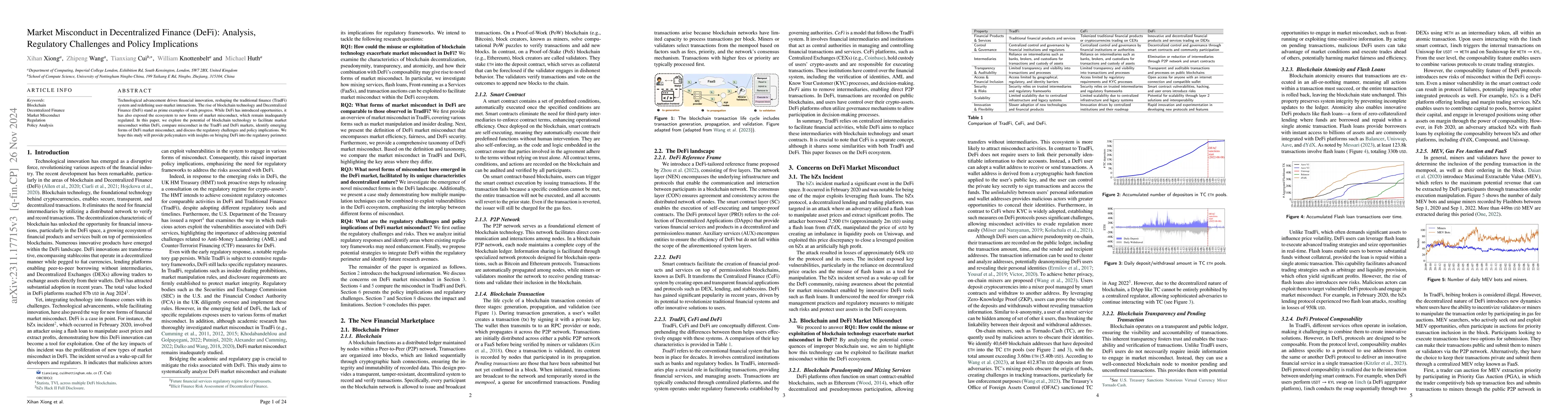

Technological advancement drives financial innovation, reshaping the traditional finance landscape and redefining user-market interactions. The rise of blockchain and Decentralized Finance (DeFi) underscores this intertwined evolution of technology and finance. While DeFi has introduced exciting opportunities, it has also exposed the ecosystem to new forms of market misconduct. This paper aims to bridge the academic and regulatory gaps by addressing key research questions about market misconduct in DeFi. We begin by discussing how blockchain technology can potentially enable the emergence of novel forms of market misconduct. We then offer a comprehensive definition and taxonomy for understanding DeFi market misconduct. Through comparative analysis and empirical measurements, we examine the novel forms of misconduct in DeFi, shedding light on their characteristics and social impact. Subsequently, we investigate the challenges of building a tailored regulatory framework for DeFi. We identify key areas where existing regulatory frameworks may need enhancement. Finally, we discuss potential approaches that bring DeFi into the regulatory perimeter.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSoK: Decentralized Finance (DeFi)

William J. Knottenbelt, Ariah Klages-Mundt, Lewis Gudgeon et al.

Decentralized Finance (DeFi): A Survey

Xinyu Li, Jian Weng, Chenyang Wang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)