Summary

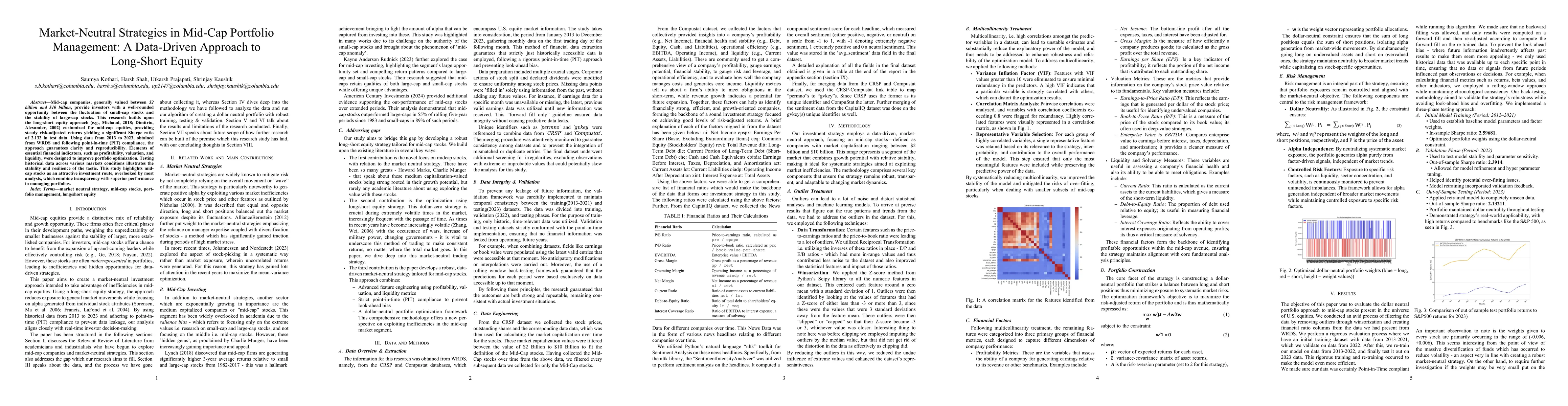

Mid-cap companies, generally valued between \$2 billion and \$10 billion, provide investors with a well-rounded opportunity between the fluctuation of small-cap stocks and the stability of large-cap stocks. This research builds upon the long-short equity approach (e.g., Michaud, 2018; Dimitriu, Alexander, 2002) customized for mid-cap equities, providing steady risk-adjusted returns yielding a significant Sharpe ratio of 2.132 in test data. Using data from 2013 to 2023, obtained from WRDS and following point-in-time (PIT) compliance, the approach guarantees clarity and reproducibility. Elements of essential financial indicators, such as profitability, valuation, and liquidity, were designed to improve portfolio optimization. Testing historical data across various markets conditions illustrates the stability and resilience of the tactic. This study highlights mid-cap stocks as an attractive investment route, overlooked by most analysts, which combine transparency with superior performance in managing portfolios.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMarket-Adaptive Ratio for Portfolio Management

Ju-Hong Lee, Bayartsetseg Kalina, KwangTek Na

No citations found for this paper.

Comments (0)