Authors

Summary

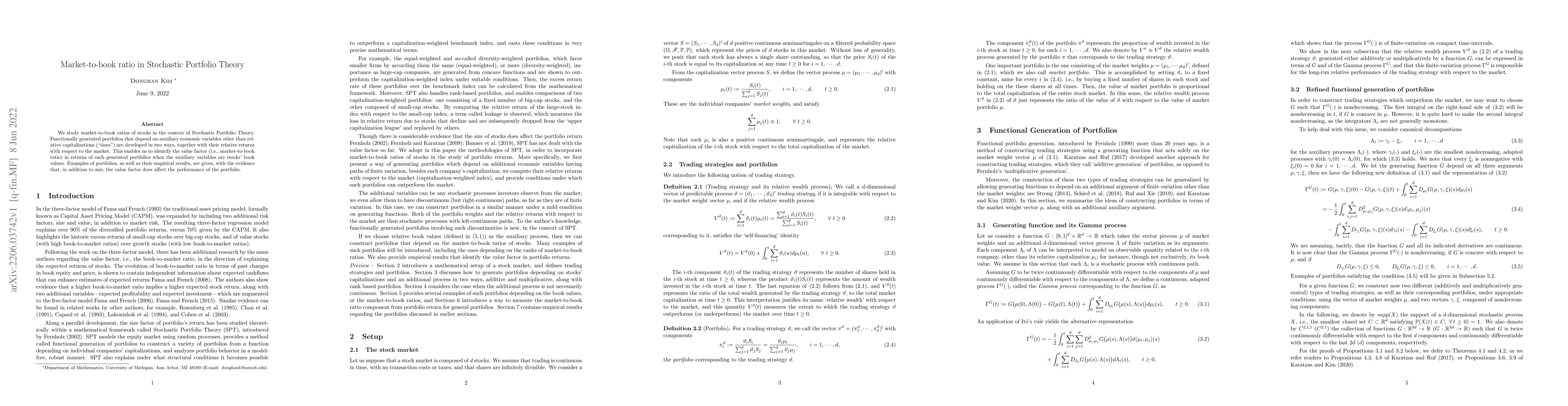

We study market-to-book ratios of stocks in the context of Stochastic Portfolio Theory. Functionally generated portfolios that depend on auxiliary economic variables other than relative capitalizations ("sizes") are developed in two ways, together with their relative returns with respect to the market. This enables us to identify the value factor (i.e., market-to-book ratio) in returns of such generated portfolios when the auxiliary variables are stocks' book values. Examples of portfolios, as well as their empirical results, are given, with the evidence that, in addition to size, the value factor does affect the performance of the portfolio.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMarket-Adaptive Ratio for Portfolio Management

Ju-Hong Lee, Bayartsetseg Kalina, KwangTek Na

Signature Methods in Stochastic Portfolio Theory

Christa Cuchiero, Janka Möller

| Title | Authors | Year | Actions |

|---|

Comments (0)